Earning interest on your crypto is a great way to make your assets work for you. Particularly if you plan on holding your crypto for the long term, earning interest seems like a no-brainer.

A popular way to earn passive income is via interest accounts and lending platforms that use decentralised finance services. In this article, we will present you with the best platforms to earn interest in crypto in Australia, based on ease of use, reputation, available assets, and other important factors.

Best Platforms to Earn Interest on Crypto in Australia - Tested and Reviewed in 2024

From our detailed research and tests, we have come up with a list of the best places to earn crypto interest in Australia in 2024. We are always updating our information, and edit our lists accordingly. You can trust that we have the best up-to-date list for you.

- 1Binance Australia - Earn Interest on 350+ Cryptocurrencies

- 2Bybit - High Rewards for Flexible Staking

- 3Crypto.com - Earn Crypto Cashback on Visa Purchases

- 4Nexo - Best Crypto Wallet for Earning Interest

How Do I Earn Interest in Cryptocurrencies?

Simply put, you can earn interest in crypto in two ways - either through staking or on lending platforms. Staking means setting aside and locking your cryptocurrency, so over time, you earn more of that crypto as a reward for contributing to the blockchain network.

Lending platforms use your crypto to loan it to others who want to borrow it and pay you interest on your cryptocurrencies. Basically, you are lending your crypto to a lending platform, which then lends it to those who want to borrow. Let's take a look at the best platforms to earn interest in crypto in Australia.

Best Places to Earn Crypto Interest - Reviews

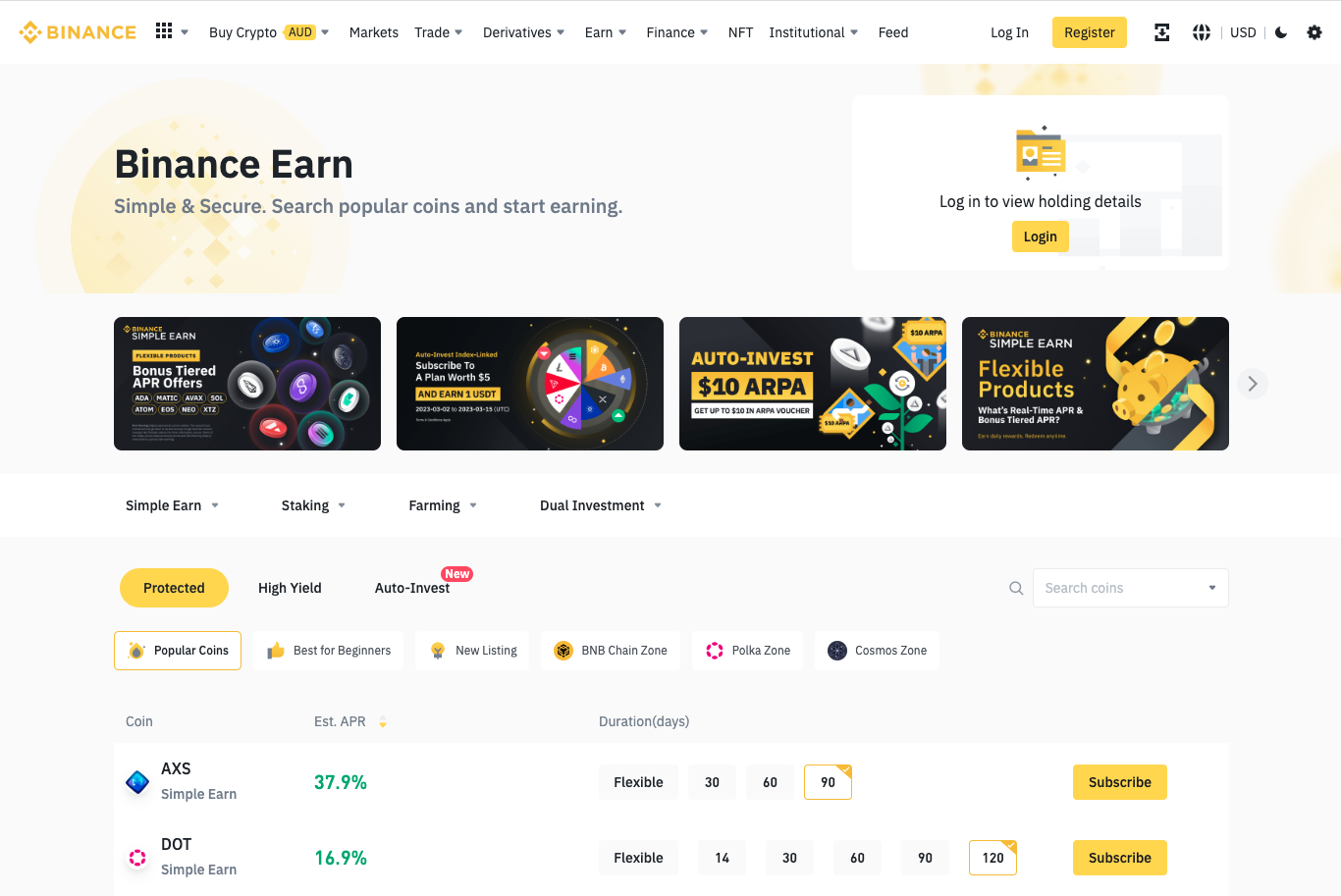

#1. Binance Australia – Earn Interest on Widest Range of Cryptocurrencies:

Binance Australia allows you to earn interest on the widest range of more than 350+ coins. The interest rates are not very high for flexible staking, but if you choose to lock your crypto for a fixed period, the rewards are much greater. For example, the interest rate on Polkadot (DOT) is only 2.25% APY for flexible staking. However, if it is locked for 120 days, the rate increases to 16.9% APY. One thing to note is that some cryptocurrencies do not have fixed rates. For example, ETH and USDT only have flexible staking options at the time of writing.

If you want to purchase crypto using Binance, you will find over 600+ coins that you can access. There are no deposit fees for AUD, and trading fees are only 0.1% per transaction, so you can get your hands on crypto at a very good price, and start earning interest on them right away. If you want to read more about Binance before signing up, see our review here.

Pros:

- Purchase or sell over 600+ cryptocurrencies

- Earn interest on over 350+ different coins

- Access higher interest rates on coins when you lock for 30, 60, 90 or 120 days

Cons:

- Some cryptocurrencies only offer flexible staking

#2. Bybit – High Rewards for Flexible Staking

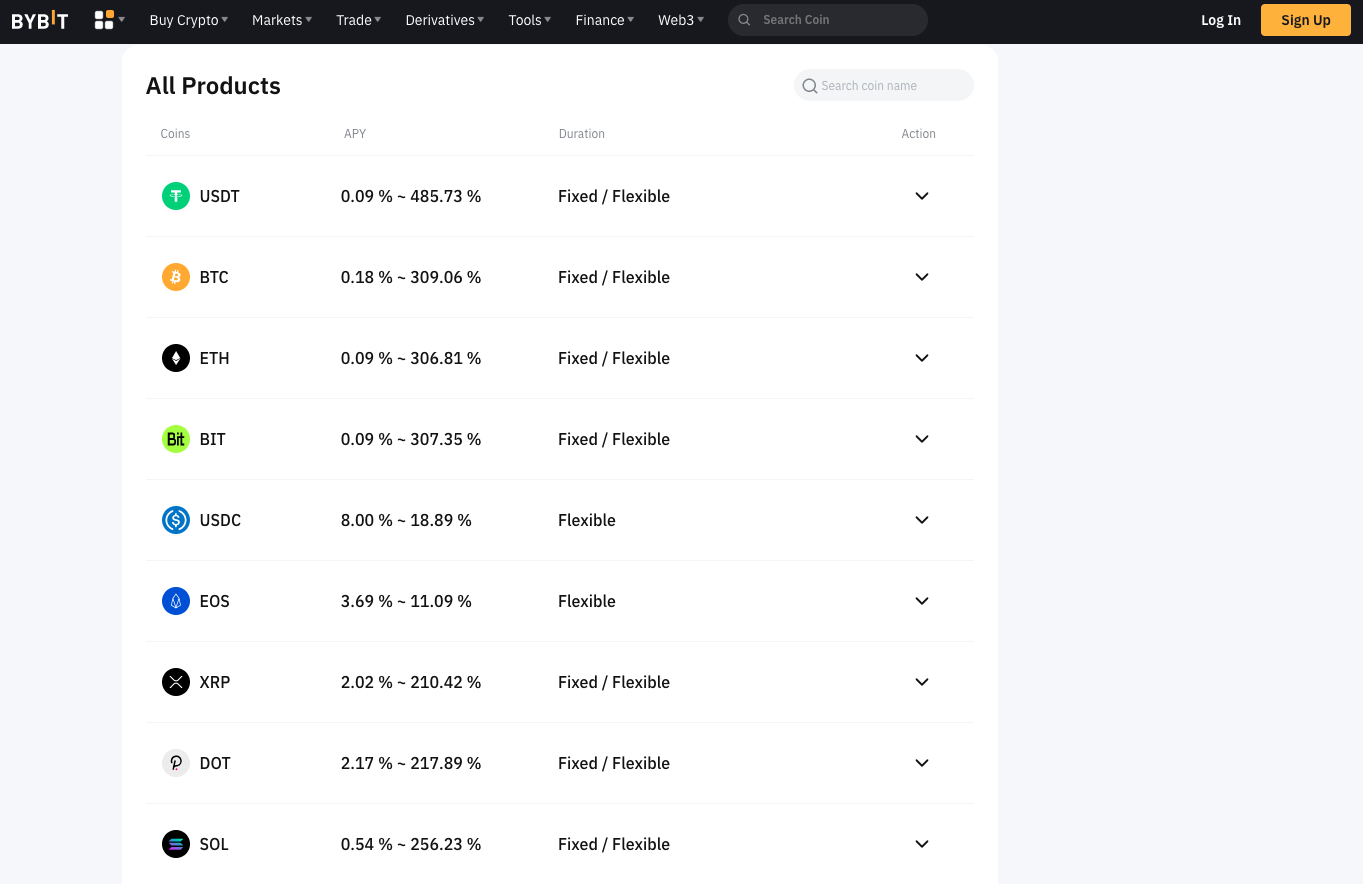

Bybit is the #1 crypto exchange in Australia, and it also fares well when it comes to earning interest. In particular, Bybit offers the best rates for flexible staking. While Binance often has higher rewards for fixed term staking, Bybit's flexible rewards are much more profitable.

For example, at the time of writing, when you stake Solana on Bybit (with no lock-in period), the rewards are 3.3% APY, compared to only 0.58% APY on Binance. If you like to stake stablecoins, USDT has flexible staking rewards of 5.5% APY, compared to Binance at only 1.64% APY.

There are some advanced options to earn interest on Bybit for experienced crypto investors. These are dual asset mining and liquidity mining. You need to do your own research on mining, and be aware of the risks first, but if you decide to go ahead, the rewards can be much higher than for staking. For example, at the time of writing, liquidity mining of USDT has rewards of 0.84 - 25.98% APY, and dual asset mining of USDT has rewards of 0.09 - 485.73% APY! These are huge returns, but be sure you understand the process before you get started.

Pros:

- High rewards for flexible staking on a wide range of coins

- No KYC required, if you prefer to earn interest anonymously

- Dual asset mining and liquidity mining are available, with much higher potential rewards

Cons:

- Fixed rates are usually not as high as Binance

#3. Crypto.com – Earn Crypto Cashback on Visa Purchases:

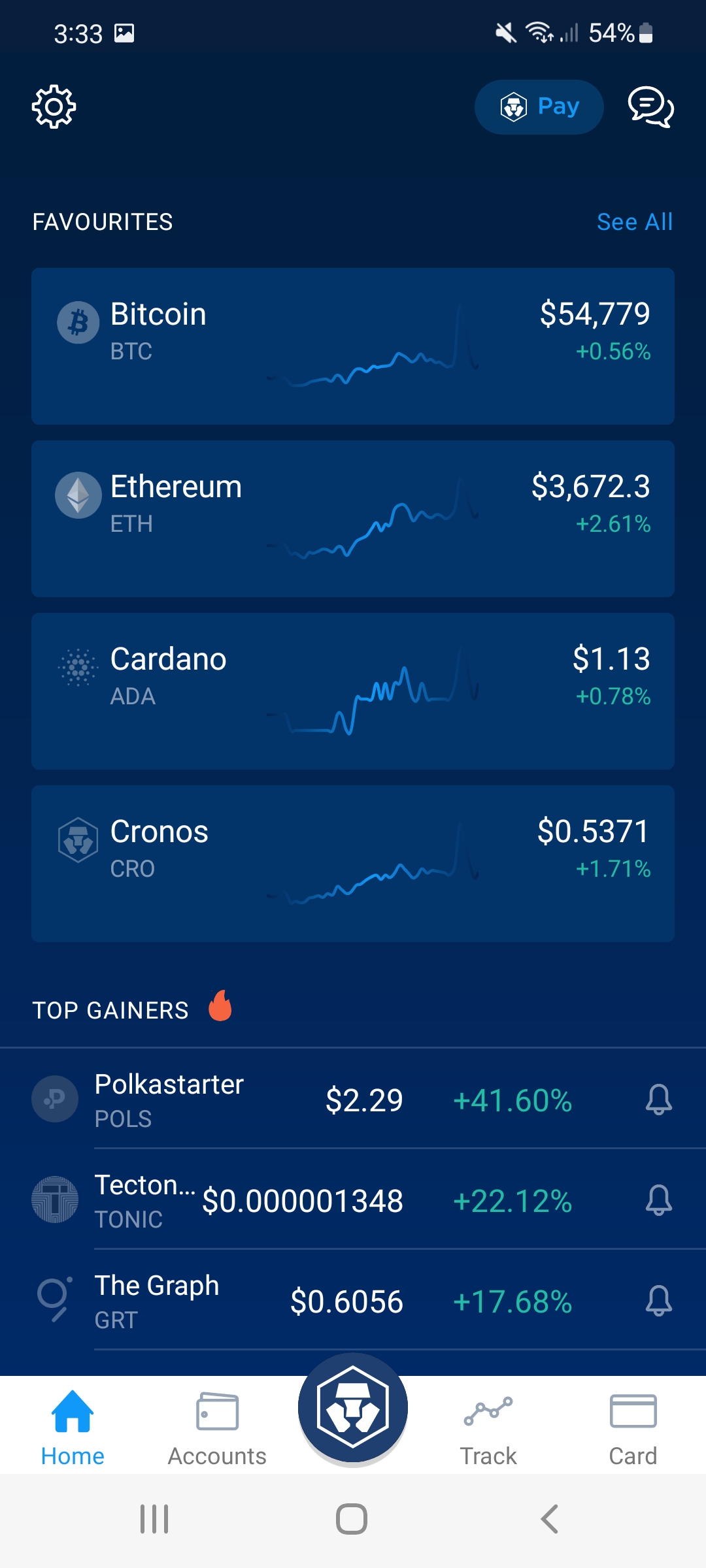

Crypto.com allows you to buy over 250+ different coins, and earn interest on 21+ of them. Due to the intuitive app that they provide, you can easily buy, sell, and swap your crypto on the same platform.

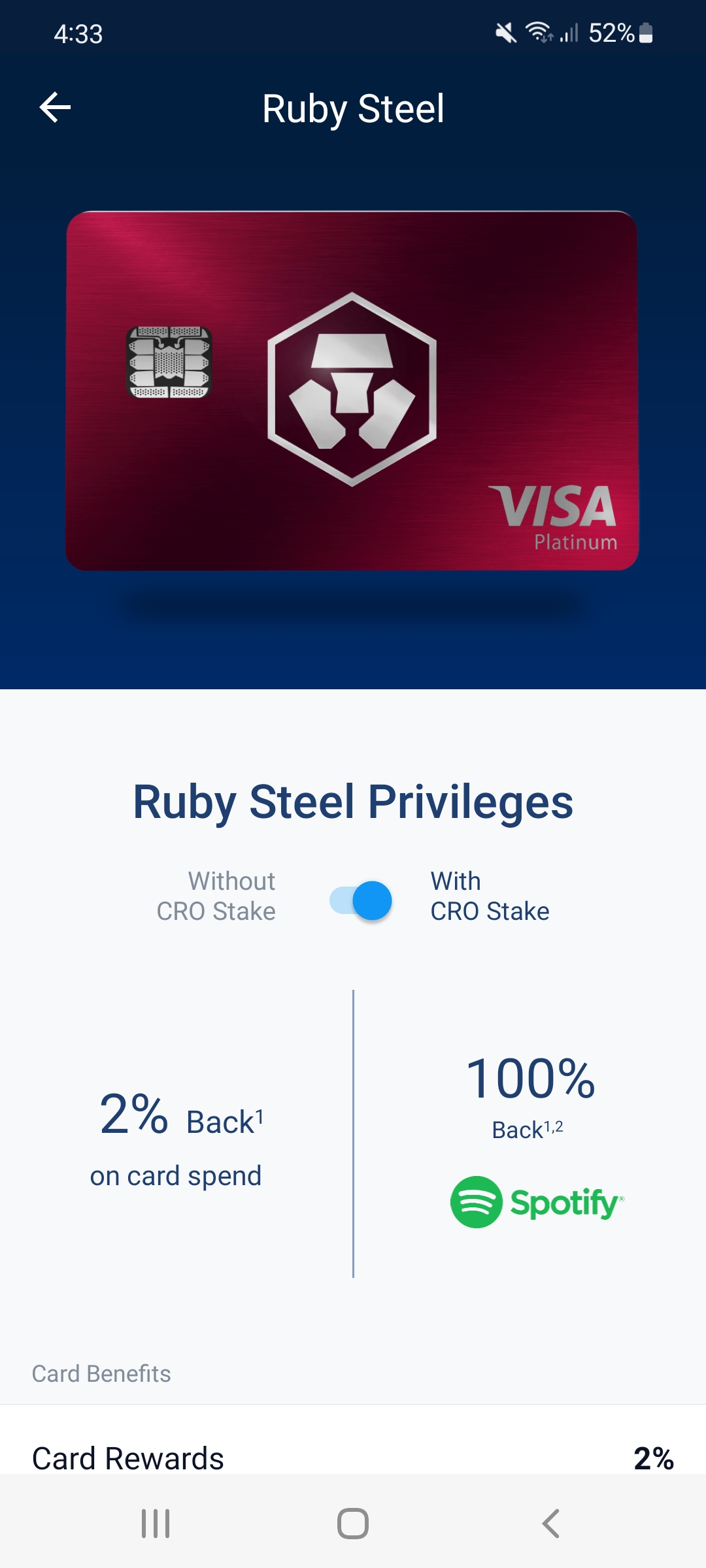

Another nice thing is that you can receive a free Visa debit card if you stake at least $500 of their native coin (CRO). You can load it with AUD and use it for online or in-store transactions and receive a certain percentage of cashback in CRO coins on your purchases. Depending on the amount of CRO you stake, you will receive between 1% and 5% back!

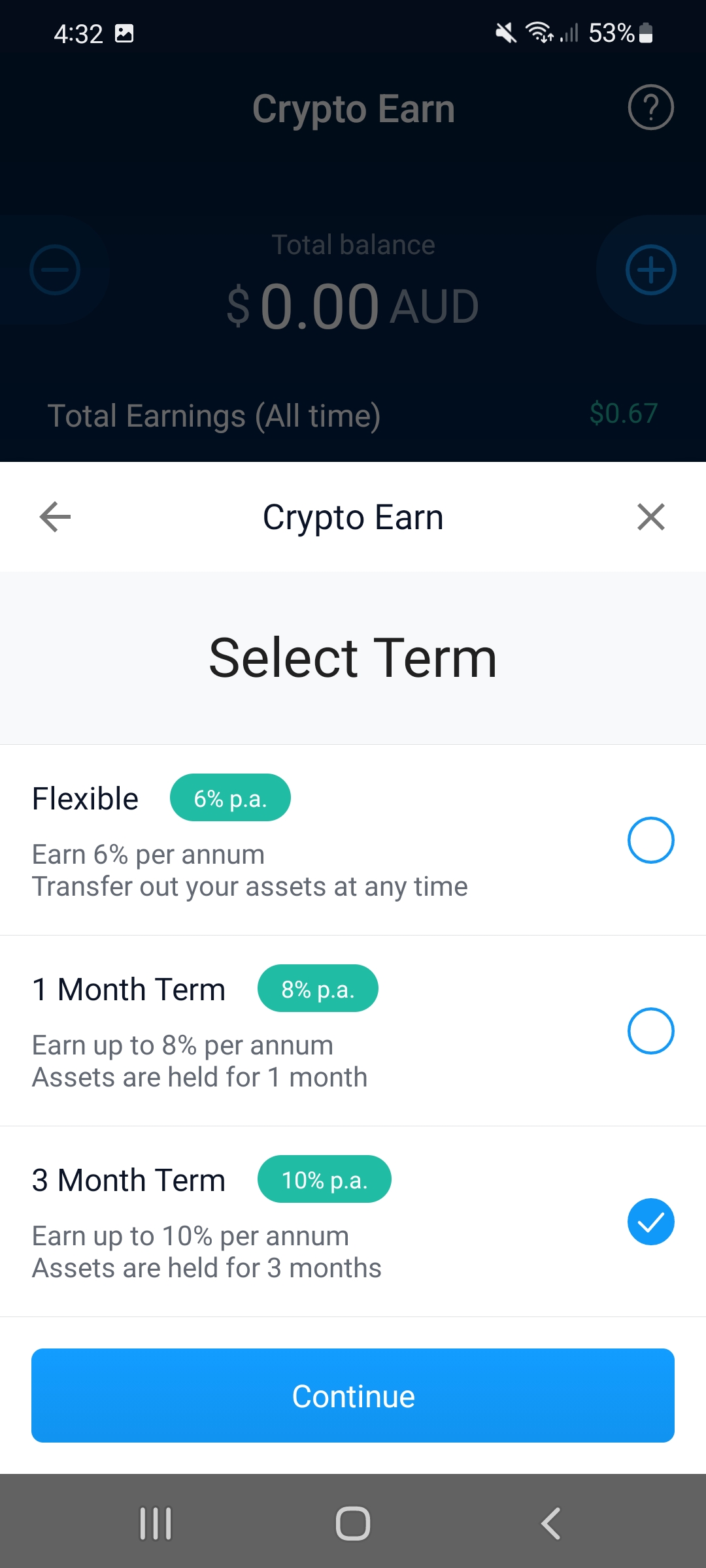

In terms of earning interest on your crypto, the rate depends on the coin you choose and whether you leave it flexible or fix it for 1 month or 3 months. If you have staked CRO, you can also access higher APY on all your staked cryptocurrencies.

Pros:

- Earn interest on more than 21+ cryptocurrencies

- Buy and sell over 250+ coins

- Stake CRO to receive a free Visa debit card that you can use to receive crypto cashback on purchases

- Stake CRO to receive higher interest rates on all staked coins

Cons:

- Need to lock your crypto for 3 months to receive good interest rates. Flexible staking gives very low APY compared to competitor platforms

#4. Nexo – Best Stablecoin Interest Rates:

Nexo is a crypto wallet where you can also earn interest on 33 cryptocurrencies. You can easily buy crypto with a card, swap between coins, and earn high interest on your coins, including stablecoins. There is an intuitive Nexo app that allows you to manage your money in a simple way, making it a great choice for beginners.

The best part about earning interest on Nexo is that your funds are more secure, since it is your personal wallet, and they have industry-leading security protocols. For example, crypto storage is in Class III vaults, data is protected by military-grade 256-bit encryption, and it has ISO 27001:2013 certification.

Nexo's rewards are particularly high for stablecoins, with a base rate of 8%. For other coins, the rates differ and you can check the current rates at Nexo's website. You can also access higher interest rates in Nexo by improving your loyalty level, which is based on the number of NEXO tokens you are holding compared to other coins in your wallet.

If you lock your coins in for 1 month you also receive additional 1% APY, and you can gain an additional 2% APY if you choose to have your rewards paid out in NEXO token instead of your original staked coin.

Pros:

- Easy-to-use for beginners

- High rewards, with options to increase the APY

- Fully regulated and secure cryptocurrency wallet

- Offers their own card which you can use for regular transactions

Cons:

- Limited number of cryptocurrencies

Conclusion

If you are looking for the highest interest rates on a wide range of cryptocurrencies, Binance is the #1 choice for Australians. If you prefer to keep your crypto flexible when staking, then we suggest Bybit, as they offer the best rates for flexible staking. You should consider what's best based on your personal needs, but you won't go wrong with any of the platforms in this article.

Feel free to read our privacy policy.