Serwah Artafu is an ‘afro-futuristic’ NFT style artist from Sydney. It came as a surprise to many when she sold her first-ever NFT for $30,000 at a digital art showcase. The second NFT was sold for $70,000. In 2021 Paris Hilton wrote her a message on Instagram asking for a commissioned piece. The art named ‘Aether: Galaxy Goddess’ is a representation of a woman controlling five planets. It was sold at a Sotheby’s digital auction.

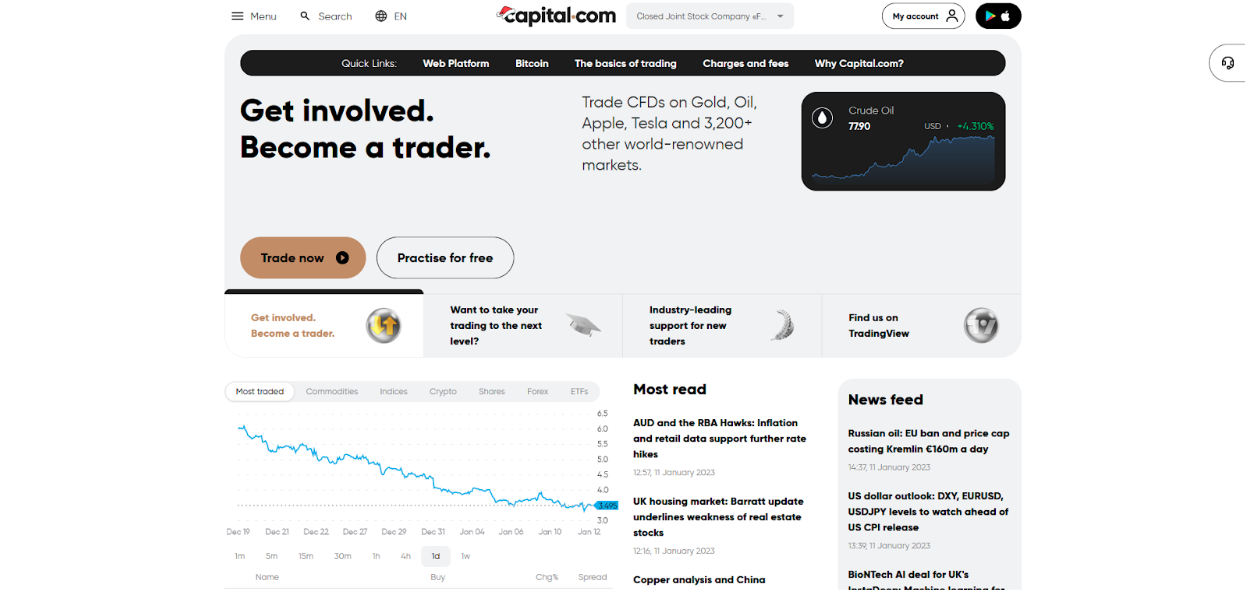

What is Capital.com?

Capital.com aims to shake up the world of online trading with its innovative platform and commitment to democratising finance. Boasting an impressive portfolio of thousands of assets and a wide array of features, this CFD (Contract for Difference) trading giant has something to offer traders of all levels.

For us, what sets Capital.com apart from its competition is its global reach as it is available in more than 180 countries. This list also includes Australia where its Melbourne-based AFS-licenced headquarters ensure that Australian investors have unrestricted access to almost every major asset and financial product.

But it's not just accessibility that Capital.com prioritises; it's also education. It equips traders with the tools and knowledge they need to succeed with its arsenal of educational resources. These include pinpoint market insights, engaging webinars, the latest industry updates, and a free demo account to test the waters before diving in.

As far as actual trading is concerned, Capital.com's automated trading options and diverse range of markets like forex, crypto, and indices make it a solid consideration for both novice and experienced traders. Not to mention its multiple deposit & withdrawal methods, minimal fees, and commitment to making trading accessible to all.

Join us as we unravel the ins and outs of Capital.com and see how it stacks up for Australian investors!

About Capital.com

Ever since its launch in 2016, Capital.com has had one clear goal, which — in their own words — is to disrupt traditional finance to benefit all. This meant breaking down the financial and structural barriers to entry for retail investors and providing them with the necessary tools and knowledge.

Today, Capital.com offers direct access to over 3,200 individual markets worldwide with global stocks, ETFs, and trade derivatives. While that is great on its own, the feature that fulfils Capital.com's original goal of accessibility is its minimum deposit of just $20 (A$29). We believe that this bridges the gap between investors from various financial backgrounds and makes more people interested in trading. It also gives us a chance to try out the platform before going all in.

Pros & Cons

Capital.com features

According to Capital.com, their platform enables four million users to realise their financial investment aspirations. So, this raises the question, what made this many investors choose Capital.com as their preferred trading platform?

Let us answer this question by understanding the defining features of Capital.com — features that make it worth your consideration. Such as:

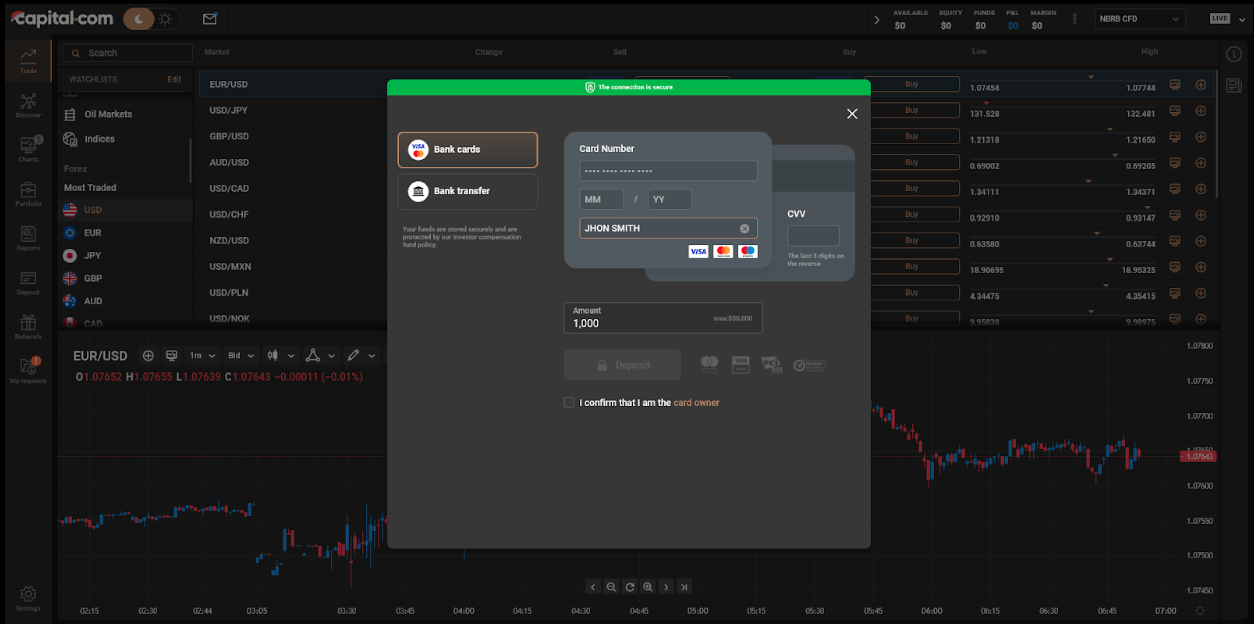

Diverse and secure payment methods

In keeping with the theme of accessibility and lower barriers to entry, Capital.com offers several payment options for Australian traders.

The most convenient of these options is your debit/credit card. Just provide your card info, enter the desired amount, and voila — your Capital.com account will be topped up with the deposited amount in no time. This is likely the payment method that most Australian investors prefer for its convenience and swiftness and we’re in the same boat.

If you don't want to use your card for any reason (security concerns, card limits, etc.), Capital.com also supports deposits from digital wallets like Skrill and Neteller — without any extra charge.

Lastly, you can also add funds to your Capital.com account through direct bank transfer. This is an especially reliable option for depositing large amounts (thousands of dollars) and works with almost every Australian bank.

It is important to note that funds from a direct bank deposit can take anywhere from a few minutes to 48 hours to appear in your trading account. Though from our test, the funds were transferred in a little over 10 minutes; not instantaneous, but not too slow either.

Over 6,000 CFDs from 3,200 markets

Capital.com is a one-stop shop for traders looking for a wide range of investment opportunities. It offers over 6,000 CFDs spanning across 3,200 different markets — giving Australian traders access to global markets without any hiccups. The key benefit of this variety is that it allows investors to diversify their portfolios, which — if implemented correctly — can help minimise risk and maximise profits.

Now, if you're new to trading, reading about 6,000+ CFDs might make you anxious & nervous. After all, how can you find the right trade from this many options? Well, Capital.com has divided these assets into distinct categories: indices, forex, commodities, cryptocurrencies, and shares — making them easier to search and locate. On our first sign up, we were able to find Gold, Solana, and ASX200 all in under a minute.

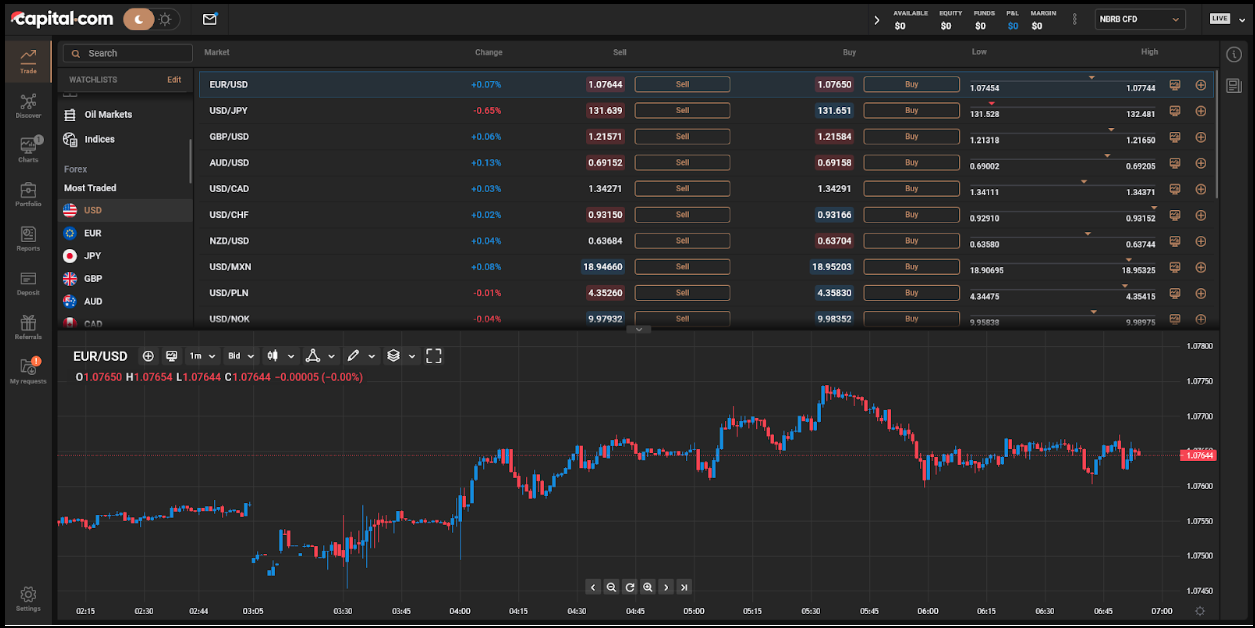

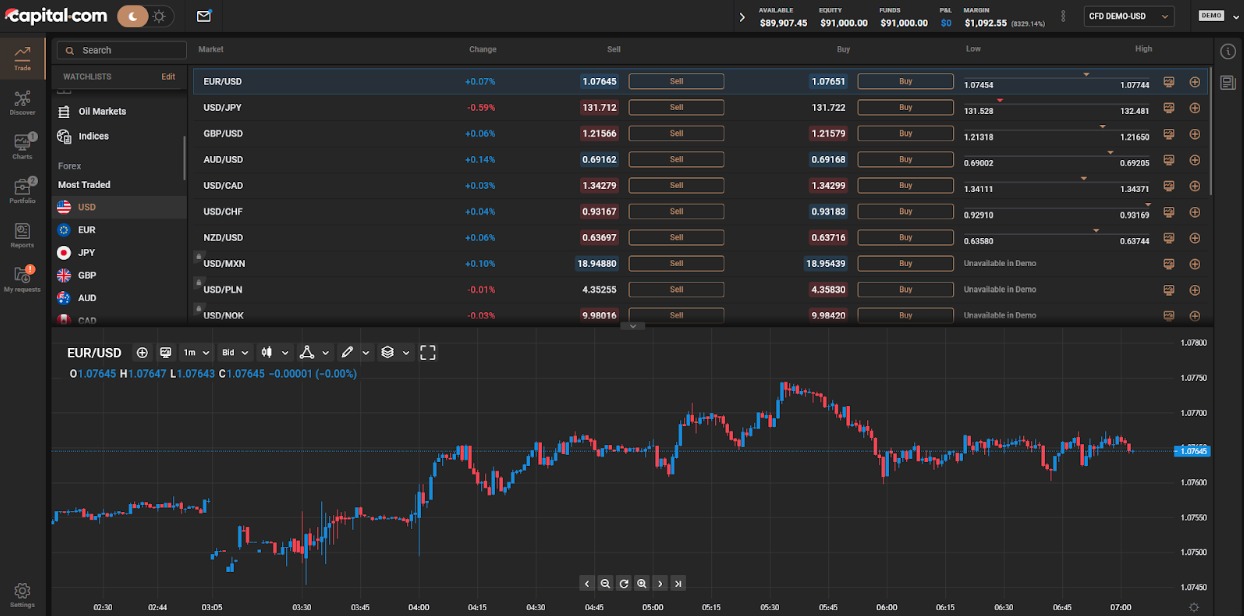

Beginner-friendly & expert trading interface

Capital.com starts new traders with a fairly straightforward and intuitive, default trading interface. It includes a list of the categories, assets from the selected categories, and a chart at the bottom. If you're a novice trader, you can likely understand and begin your trading journey in minutes with this layout.

But what if you're like us; a seasoned trader who requires more on-screen information to make the right calls? We wanted to see what underlying tools Capital.com offers for folks already experienced in CFD trading. And, after a little digging around, we found numerous chart customisation options, such as different layers, drawing tools, indicators, chart types, and more granular interval options.

You know the best part? We only had to make these customisations once as all of our tweaks were already implemented on subsequent logins — making our trading experience hassle-free.

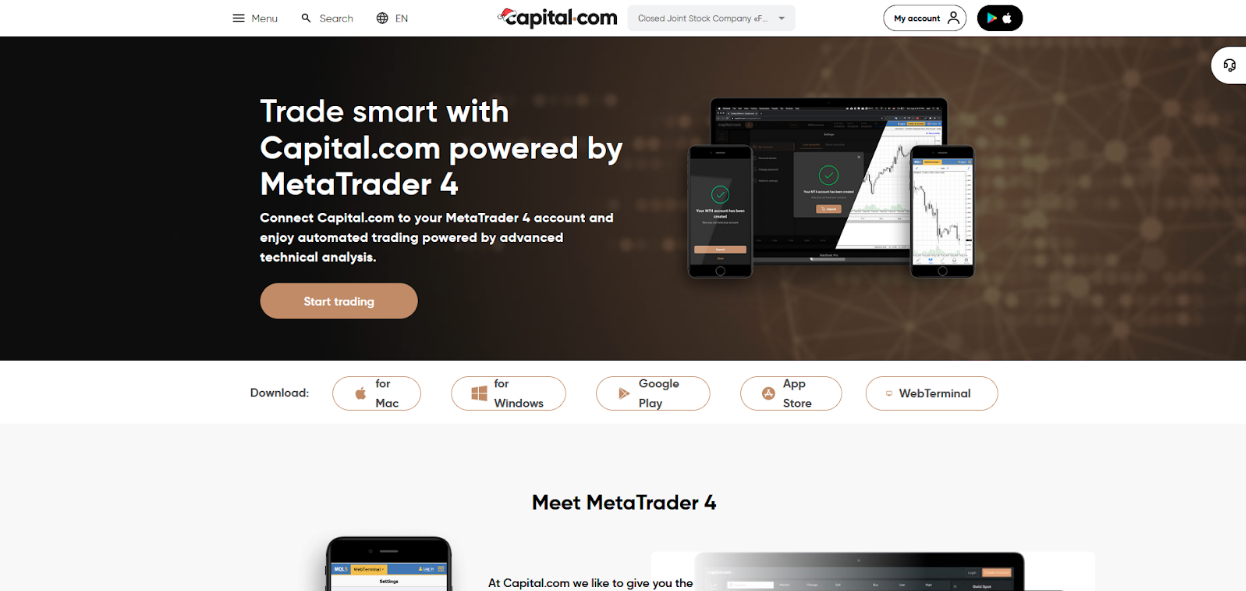

MetaTrader 4 integration

MetaTrader 4 or MT4 by MetaQuotes is pretty much the standard software for forex trading and we completely agree with this sentiment. It offers unparalleled layout freedom and feature integration with bots and scripts.

So, if you're looking for a more detailed and customisable trading layout, Capital.com's got you covered with its complete MetaTrader 4 integration. All you have to do is download & install MT4 on your preferred device and log in with your Capital.com account. (We prefer the desktop versions but you can get it on mobile as well.)

For us, the biggest reason to utilise this feature is for algorithmic automatic trades. Just set up custom trading parameters, and the software will use smart algorithms to make those trades 24/7. Even if you're trading manually, MT4 is worth your consideration for its 85 pre-installed custom indicators that allow you to control positions quickly and effectively.

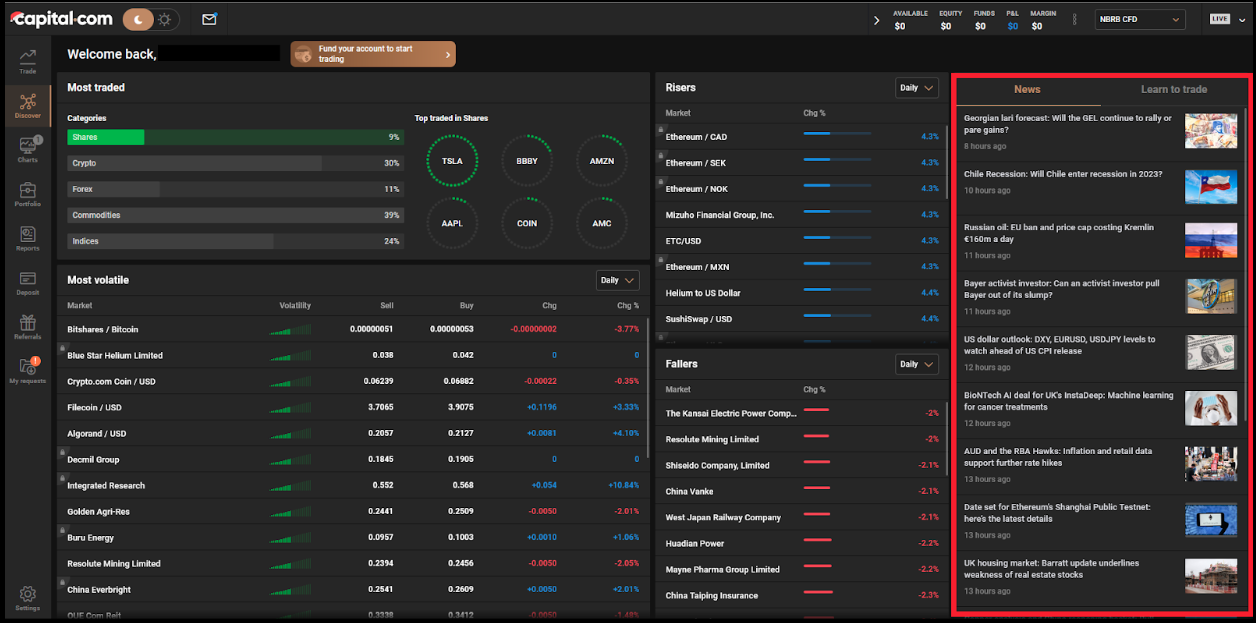

Latest news and analysis

As we've mentioned several times by now, Capital.com wants to make trading accessible for as many people as possible. To accomplish this, the platform includes over 5,000 pages of financial content and analysis, alongside a growing list of videos on financial topics. We went through a good portion of these and found them to be an intuitive learning tool for newer traders.

Not to mention the latest international finance news available on the "Discover" tab of your trading interface. It includes all the info you need to stay in the loop about ongoing matters & upcoming changes to the financial world.

Moreover, if you're new to trading and want to improve your chances of success, Capital.com also offers webinars with their Chief Market Strategist, David Jones.

Demo account

Staying on the topic of getting better at trading, the Capital.com demo account is the most efficient learning tool at your disposal. Here's how it helps.

While reading papers or watching videos has its merits, the best way to learn trading is through experience. But — unless you have thousands of dollars burning a hole in your pocket — starting trading willy-nilly is never a good idea. We’ve seen countless traders jumping in with the mindset of “I’ll learn as I go” and then losing all of their investment funds in weeks or even days.

This is where the demo account comes in. It gives you thousands of dollars of virtual money. You can spend this money on trading with forex, crypto, futures, etc.; just like you would with real money. You can then analyse the outcome of your trades, understand the mistakes, and try again until you get the hang of it. Once you have enough hands-on experience, you're ready to switch over to a live account with real money and put your experience to the test.

Another benefit of this demo account is that it acts as a testing ground for veteran traders looking to switch to a new platform. With it, we were able to test out the features and trading capabilities of the platform without depositing a cent.

Generous affiliate program

Capital.com's affiliate program gives you the opportunity to make some extra money alongside your trading profits.

All you have to do is look for friends, family, or co-workers interested in online trading and ask them to join Capital.com. They can be from Australia or any of the 180 jurisdictions.

As long as they sign up on your recommendation, you will get a CPA cut of up to $800. The more people you bring to the platform, the more you'll earn. There is also an option to get an ongoing 30% revenue cut, which tends to be the better option in our experience. Unfortunately, it is not available in the UK, Europe, and Australia.

Supported assets on Capital.com

Capital.com offers CFD trading on five key asset types. These include:

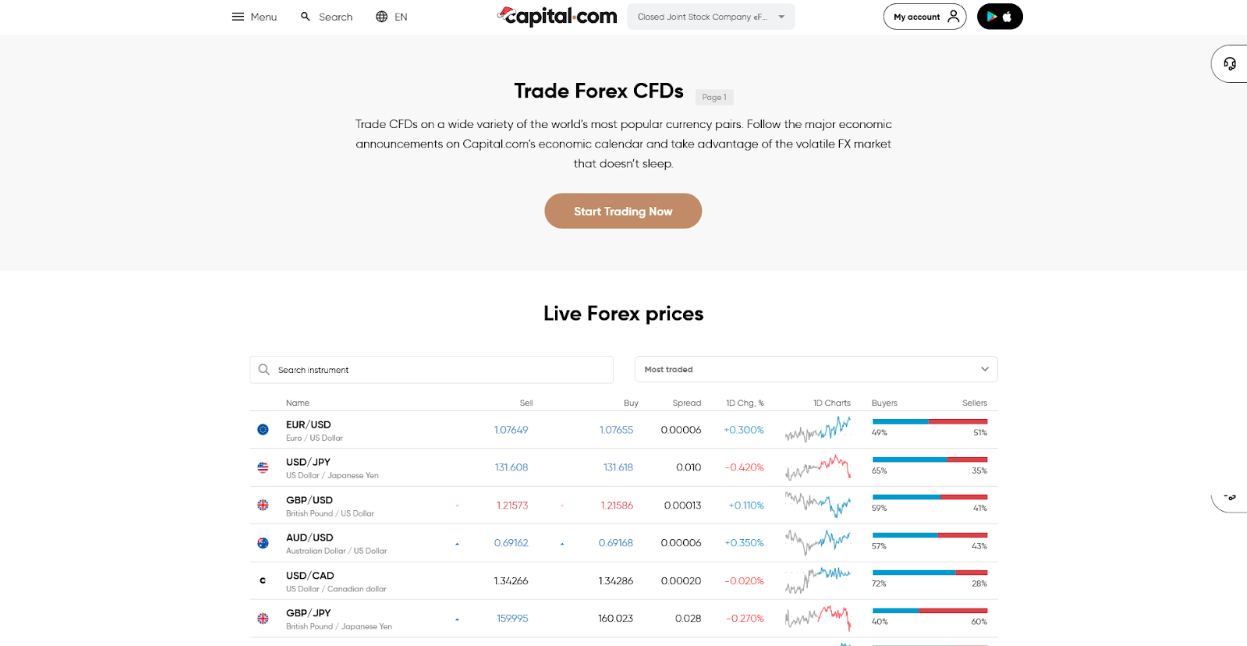

Forex

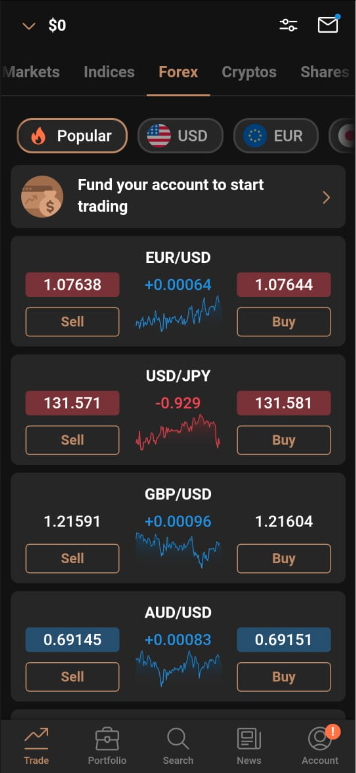

Forex or Foreign Exchange is the global market of trading currencies with one another. Since the forex market itself can be quite volatile, trading with CFDs lets traders speculate on both the price increase and decrease of any given currency pair. With Capital.com, you can purchase CFDs for many popular currency pairs, such as EUR/USD, USD/JPY, GBP/USD, and more.

Indices

Think of indices as groups of market assets. Some of the most popular examples of these include S&P 500, FTSE 100, Dax 30, and Australian S&P/ASX 200.

Capital.com allows you to purchase CFDs for these market groups and speculate on their overall performance.

Commodities

Commodities refer to industrial materials such as oil, natural gas, gold, silver, and iron. With Capital.com CFDs, you can trade commodities and speculate on their prices without owning the commodity in question — making it an excellent choice for retail investors.

Shares

Shares are the equity ownership in publicly listed corporations like Tesla, Apple, Microsoft, Alphabet, and Meta. The prices of these shares can rise and fall dramatically depending on factors like product launches or yearly financial reports. So, with the right planning, share CFDs can be a good source of profit. We personally utilised CFD share trading to great success during the whole Gamestop short squeeze fiasco.

Cryptocurrencies

Cryptocurrencies are decentralised digital currencies backed by the blockchain. Prominent examples of these include Bitcoin, Ethereum, Litecoin Ripple, Dogecoin, and more. While you can purchase the cryptocurrency and wait for its price to increase, trading CFDs is much more efficient.

Customer support

When reviewing a trading platform — especially one geared towards new traders — we put great emphasis on the quality of its customer support. So how does Capital.com fair in this regard?

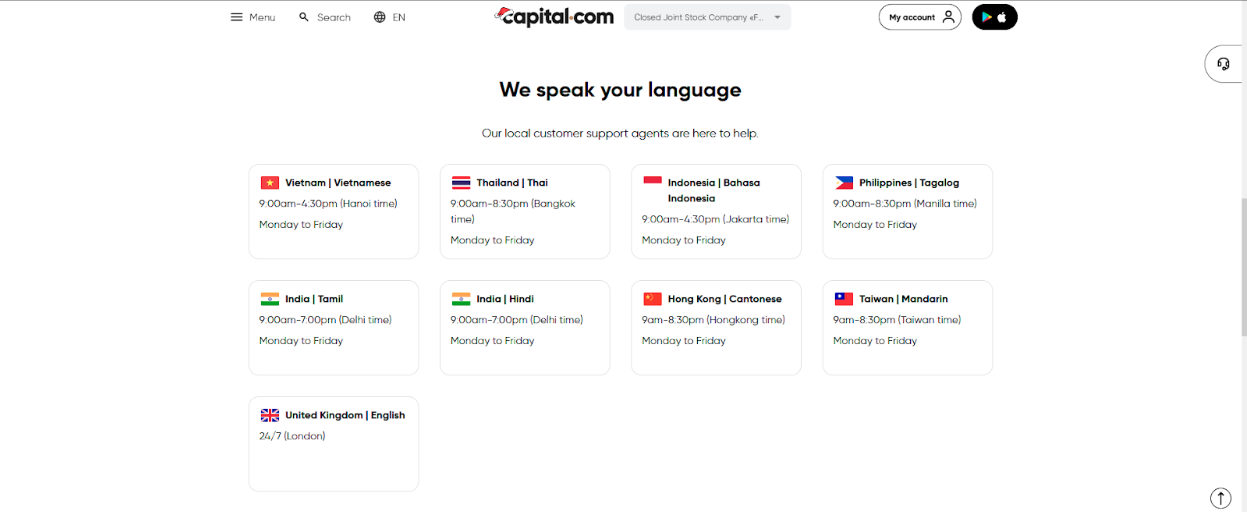

Well, Capital.com's customer support network is as vast as its platform. Its website lists support lines in nine different languages, including but not limited to Mandarin, Hindi, Vietnamese, and Thai. For the English-speaking folk of Australia, a London line is available 24/7.

If the issue is not that urgent, you can send them an email at support@capital.com, and a support agent will reply back as soon as possible.

What impressed us more is the immediate assistance you can get via their live chat, WhatsApp, Viber, Telegram, and Facebook Messenger.

Keep in mind that 24/7 instant reply is only available for English. There are set operating times for other languages which you can find on Capital.com's Customer Support page.

Mobile support

The Capital.com website and desktop application is the primary trading method, with the most features and customisation options. But, most traders cannot sit in front of their computers all day, waiting for the optimal trading opportunity.

To resolve this issue, Capital.com offers a robust iOS and Android app that has the speed and reliability of its desktop counterpart, just presented in a more streamlined package. In addition to its super beginner-friendly UI, we also found an option to turn on push notifications for the performance of our positions and critical financial news.

Capital.com fees for users

Capital.com prides itself as one of the more affordable and cheap trading platforms on the market and it’s easy for us to see why. Here's how much you — the average trader — would have to pay on this platform.

Deposit fees

Depositing on Capital.com does not incur any fee. This remains true no matter how much or how little you deposit. It is also not affected by your deposit method, be it a credit/debit card, direct bank transfer, or transfer from a digital wallet.

That said, Australian users might not receive exactly the same amount in their account as they deposited. This is because Capital.com does not offer an AUD account. So, your deposit will be converted into USD, EUR, or GBP, and you will have to pay a small fee for this conversion.

Trading fees

During our use, Capital.com was taking a fee with each trade but it wasn’t fixed or had a commission-based system. With a little digging, we found out that the trading fee was built into the spread of your CFD purchases. The platform was increasing the average spread by a small amount, and the difference was cut with each trade.

This increase in spread also appears to depend on factors like the day of the week and the time of day. An overnight premium is also applied if you keep a position overnight in leveraged trading.

Withdrawal fees

We were pleasantly surprised to learn that, just like deposit, Capital.com doesn't have a withdrawal fee either. We were able to withdraw everything from our account without losing a cent. But, Australian traders might have to pay a conversion fee on withdrawal as well if they're not withdrawing to a USD, EUR, or GBP bank account.

What do the reviews and ratings show?

Capital.com customer reviews are generally very positive. This is best illustrated in its score on Trustpilot, which is 4.3 stars out of five; averaging from 8,450+ reviews.

A five-star review from Sam states, "Excellent platform, easy to use, intuitive, and provides all the necessary tools to help investors make informed investment decisions."

We see a similar trend in its evaluation from popular review websites. Ratings from these in-depth reviews are between 4.3-5 out of 5 stars. Most praise comes from Capital.com's beginner-friendly layout, low minimum deposit, and inexpensive operation.

This is not to say that all reviews are positive. Some negative reviews about this platform include gripes about a customer's bad experience with the support system or lack of certain features like PAMM accounts and automated copy trading.

How does Capital.com compare with the competition?

While Capital.com has gained significant popularity in the past few years, it is far from the only CFD trading option on our radar. Here's how it stacks up against its competitors.

Capital.com vs. Plus500

The biggest advantage of Plus500 over Capital.com is its trust factor. Plus500 is usually more trusted by reviewers like us and professional traders because it has four Tier-1 licences compared to the two owned by Capital.com.

If we consider asset variety, on the other hand, Capital.com wins with ease as it offers 6,000+ CFDs compared to the 2,800+ CFDs by Plus500.

Capital.com vs. eToro

eToro holds the same number of Tier-1 and Tier-2 licences as Capital.com but it still has a better trust score. This is because eToro has been in business since 2007 while Captial.com entered the market nine years later in 2016. Another place where eToro takes the edge is in minimum deposit amounts since it allows initial deposits as low as $10.

That said, Capital.com offers almost double the amount of CFDs. We also found Capital.com’s mobile app to be much more feature-rich and responsive.

Capital.com vs. IG

IG is one of our most trusted CFD trading platforms with nine Tier-1 licences. It also offers 19,537 tradable symbols, which is more than three times the Capital.com catalogue.

But IG also has a £250 minimum deposit. So, if you're just starting out and don't want to spend a lot of money, Capital.com is still the better option for you.

How safe is Capital.com?

Capital.com is licensed and regulated by the Australian Securities & Investments Commission and other Australian authorities — cementing Capital.com as a legitimate trading platform for Australians.

The platform is also equipped with PCI Data Security Standards. In short, your funds (deposits/withdrawals) are routed through the safest data environments. Your information is also kept safe with Transport Layer Security encryption which is backed up every day to prevent any data loss from potential malicious attacks.

You — the user — also have the option to secure your account with strong encrypted passwords and two-factor authentication. On mobile devices, the Capital app can also be locked with biometrics.

What makes Capital.com unique?

From our experience, there are two key factors that make Capital.com unique in the financial trading market, and we've discussed both earlier in the review. These are:

Unusually low cost

If you're on a low budget, trading on Capital.com is surprisingly economical. First, you don't have to pay any deposit fee, and the minimum deposit amount is just $20. Secondly, there are no fixed trading fees or commissions that are cut from your profits. The platform deducts a fee from spread margins which vary between trades, time of the day, and day of the week.

Lastly, there are no withdrawal fees either; a feature that we don't find on most CFD or traditional online trading platforms.

Balanced feature set

Somehow, we found Capital.com to be fit for both trading beginners and experts.

Its default trading layout is ideal for newcomers as it doesn't overload them with graphs, lines, and numbers. But it still includes enough info to allow thoughtful trades.

For the experts, there are tons of customisation options that can transform the layout into an advanced mode of sorts. It includes a lot more indicators, performance metrics, and parameters on the screen at once.

Frequently Asked Questions

CFDs, or Contracts for Difference, are a type of financial instrument that allows traders to speculate on the price movements of various underlying assets, such as stocks, commodities, currencies, and indices. These contracts are a form of derivative trading; allowing traders to gain exposure to the underlying asset without actually owning it.

CFDs also have several advantages over traditional trading methods. They offer a higher degree of flexibility and allow traders to take advantage of market movements in both rising and falling markets. They also provide a greater degree of liquidity, which means that traders can enter and exit trades quickly and at any time. Additionally, CFDs have low barriers to entry, which makes them accessible to traders with limited capital.

Leverage in CFD trading refers to the ability to trade with more money than the trader has in their account. It is a way for traders to increase the potential returns on their investments, but it also increases the potential for losses. In other words, leverage allows traders to control a larger position in the market with a smaller amount of capital.

In CFD trading, leverage is provided by the broker, who acts as a lender and allows the trader to open a position with a smaller amount of capital than would be required if they were to own the underlying asset outright. For example, if a trader wanted to trade a stock that is valued at $100 per share and the broker offered a leverage of 1:10, the trader could open a position with only $10 while still having the same exposure to the stock as if they had invested $100.

No, Capital.com does not offer any bonuses or promotions for new traders. However, it does have an affiliate program that can get you a CPA cut of $800 if someone else joins the platform from your recommendation. You can also choose a 30% revenue share instead of the one-time CPA if you're outside of the UK, Europe, and Australia.

Capital.com's demo account starts you with $1,000 of virtual money. If you want more money, just click on the downward-facing arrow in the upper right corner. Next, click the "Top Up $10,000" button, and 10,000 virtual dollars will be added to your account. You can repeat this process nine times, as the maximum possible fund in demo accounts is $91,000.

No, you cannot. Capital.com is a CFD trading platform where you can speculate on the price of financial assets like shares, commodities, and cryptocurrencies. There is no way to buy these assets on Capital.com.

If you're interested in buying these assets in Australia, we recommend looking into traditional trading platforms like Bybit and eToro.Conclusion

Is Capital.com the best CFD trading platform for Australian traders? There is no way to fully confirm or deny this question since different traders may have different experiences with the same platform.

What we do know for sure is that Capital.com is a well-rounded choice for both beginners and trading experts.

Its $20 minimum deposit requirements and zero deposit or withdrawal fee make it a worthwhile consideration for folks looking to try CFD trading for the first time. Simultaneously, Capital.com's customisable trading layout, in-platform news network, and MT4 integration cement it as a solid choice for seasoned Australian traders.

If you're still unsure whether Capital.com is the right platform for you, give its demo account a try. You can get more than $90,000 in virtual money to test out its trading layout, reliability, and speed before making a final decision.

David Porte Beckefeld is an artist from Sydney specialising in 3D still and motion design and CGI art. He sculpts his pieces within the realm of virtual reality and sells them as NFTs. His distinctive characteristics are the use of bright colours, a mix of textures, and the addition of music in some of his pieces.