Key Takeaways

- The spread in crypto refers to the difference between the buy and sell prices of a cryptocurrency.

- It is calculated by subtracting the sell price from the buy price and expressing it as a percentage.

- To minimize the spread, it is important to choose a crypto exchange with low spreads.

- Digital Surge is recommended as it has low average spreads, such as 0.21%, compared to other exchanges like Swyftx with 0.51% spreads.

You have probably heard of the term spread when researching cryptocurrency exchanges, but maybe you aren't sure exactly what it means. Here at Debt Bombshell we try to make everything easy to understand, even for complete beginners, so I will explain it all in simple terms.

What is crypto spread?

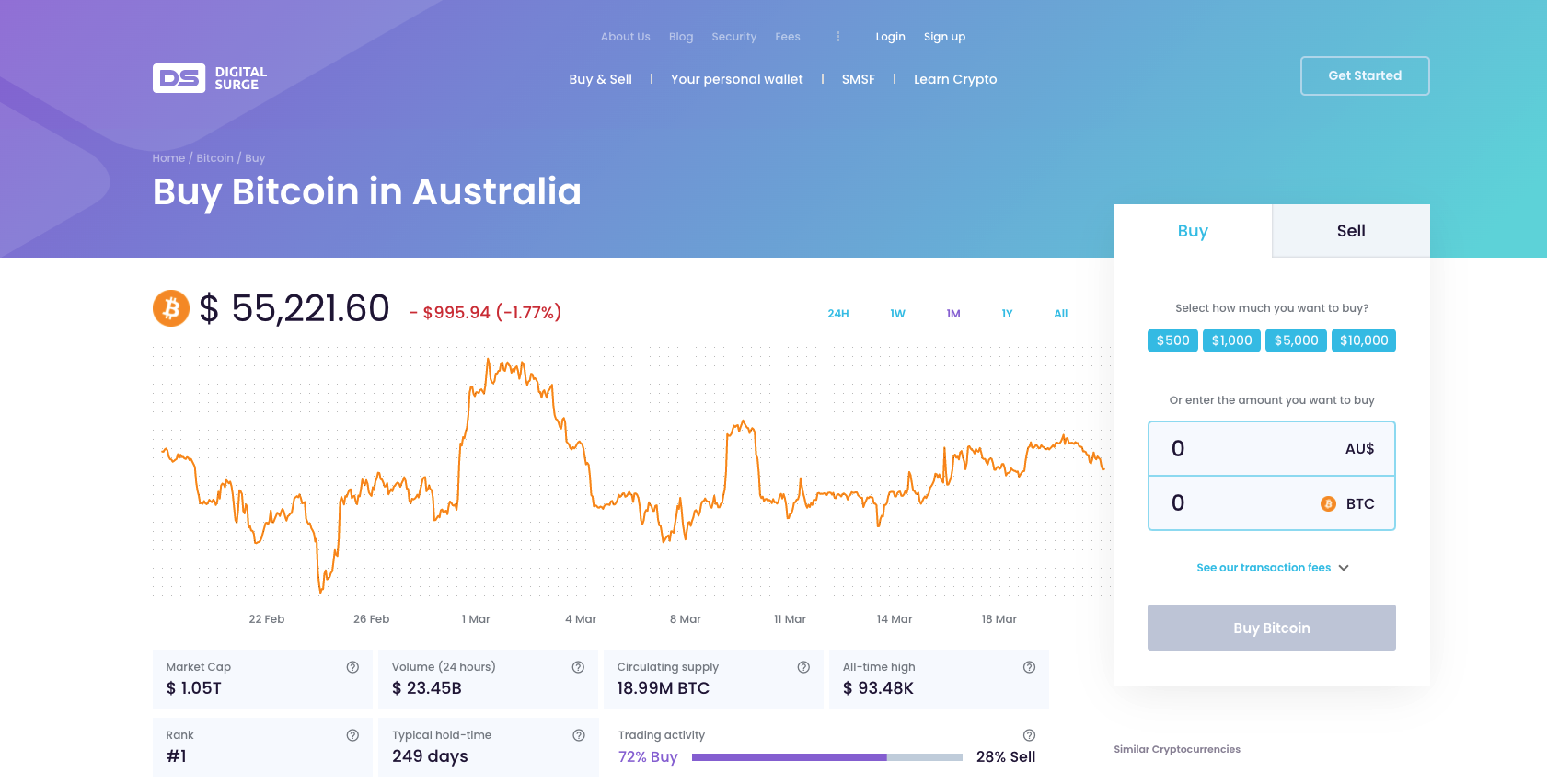

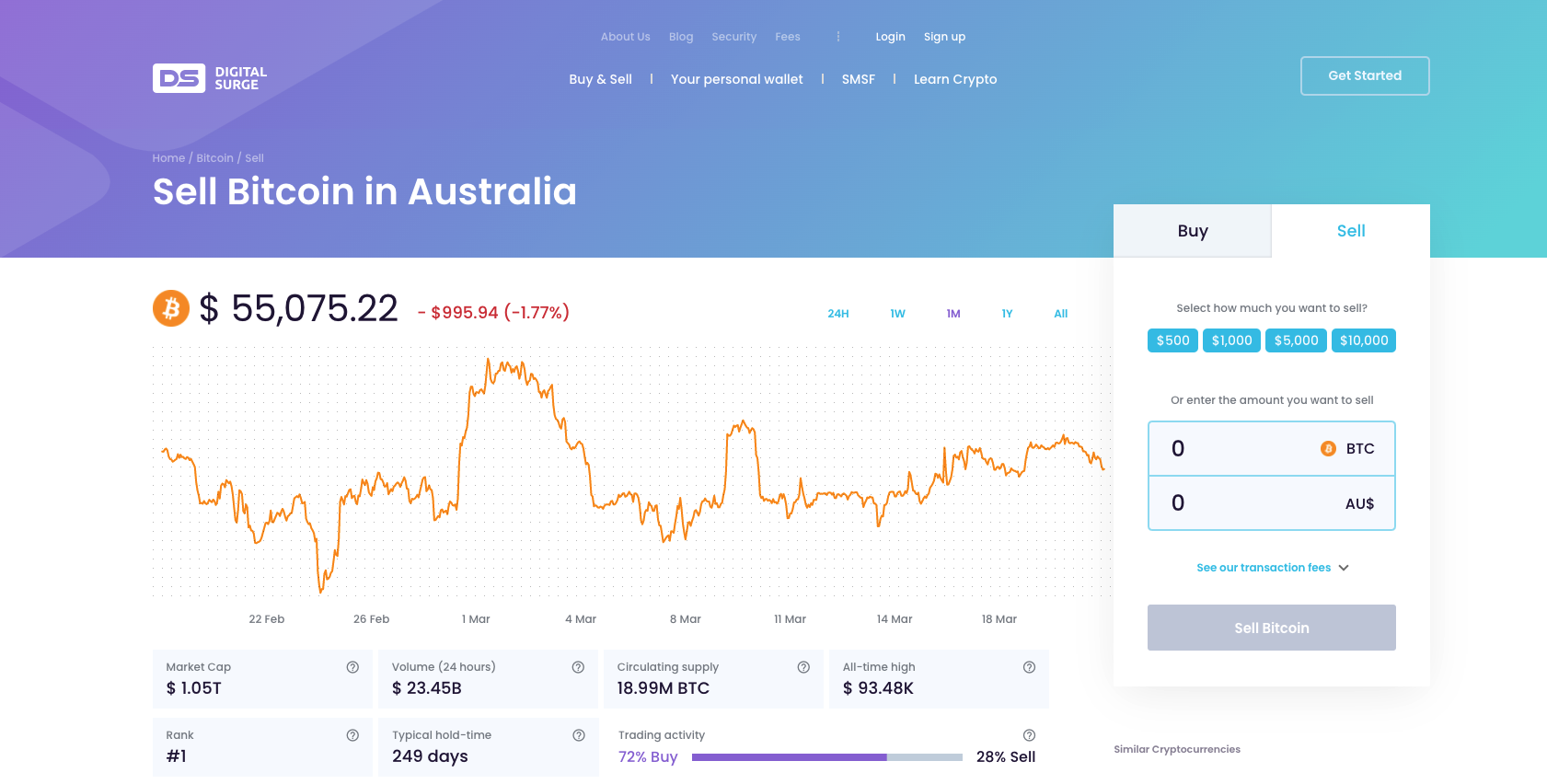

When we talk about spread in crypto we are referring to the difference between the buy and sell prices of a cryptocurrency. For example, let's take a look at one of Australia's best crypto exchanges, Digital Surge (read full review). In the screenshot below you can see the Buy price of Bitcoin (in the first screenshot) is $55,221.60. The Sell price at the exact same time (second screenshot) is $55,075.22.

This means if you buy and sold 1 BTC immediately on Digital Surge, with no fees, you would still lose $146.38 The spread is usually expressed as a percentage, and in this case, the spread is 0.265%, which is very low. Keep reading to find out how to calculate the spread yourself.

How do you calculate the spread in crypto?

Most crypto exchanges do not mention their spread, because it is in effect a hidden fee. You can calculate the spread yourself to work out how much they are charging. This in-depth test by Marketplace Fairness shows how much spreads can vary across Australian crypto exchanges, and Digital Surge is the clear winner.

To calculate the spread, first subtract the sell Price of a cryptocurrency from the Buy price. Using the screenshots above as an example, you would use this equation:

55,221.60 - 55,075.22 = 146.38

Now divide that answer by the Buy price, and multiply by 100 to get the spread as a percentage. Continuing the example above, use this equation:

146.38 ÷ 55,221.60 x 100 = 0.265

Therefore the spread for Bitcoin on Digital Surge is 0.265%.

How to minimise crypto spread?

The only way you can minimise the spread when buying, selling or trading cryptocurrency, is by choosing a good exchange. Some exchanges have high spreads, and if you are using those exchanges, there is nothing you can do to lower that.

We recommend taking a look at our article on the best crypto exchanges, or this test on the lowest spreads in Australia to help you decide. Our #1 recommendation is Digital Surge (see review), with low average spreads of 0.21%, well ahead of the #2 exchange Swyftx (see review), with 0.51% spreads.