Crypto.com is one of Australia's top crypto apps and exchanges, thanks to the ease of use, wide range of 250 coins, and staking options. However, there is one more feature that has attracted many Australians, and that is the Crypto.com Visa Card.

What is Crypto.com Visa Card?

It is a FREE debit card issued by Crypto.com, and it was originally only available in the US. It finally became available for Australians in 2021, and I was one of many crypto enthusiasts who was keen to get my hands on one. You can load it with AUD or crypto, and spend it at any store online, or in person, and the best part is the benefits you receive when using it.

The main benefit is receiving crypto cashback (up to 5%) on all your purchases, which is an excellent way to grow your crypto portfolio without investing any additional money. Besides the cashback, you will also receive reimbursements on Netflix, Spotify, Airbnb, Expedia, Amazon Prime, and others. See the main points below, and my experience of using the Crypto.com Visa Card, to help you decide whether you should apply for one.

- Earn up to 5% cashback (in crypto) on all your purchases

- Free to apply for card, with 0% annual fees or transaction fee

- Benefits such as cashback on Netflix, Spotify, Airbnb, Expedia, & Amazon Prime

- Digital card can be added to Google Pay, Samsung Pay, and Apple Pay

- Physical metal card can be used in brick and mortar stores

- Can withdraw money from ATMs in Australia and around the world

- Easy way to spend your crypto

- Can load the card with AUD or crypto, as per your preferences

Features

Up to 5% Cashback on Purchases

The main feature of the Crypto.com card is the cashback received on each purchase. This ranges from 1% up to 5% depending on the colour (tier) of card that you have applied for. I will explain this below in another section.

I signed up for the Ruby Steel card in 2021, when it came with 2% cashback on all purchases. Unfortunately, in 2022, Crypto.com adjusted the cashback amounts and now I only receive 1% cashback. If you want to receive 2% cashback, you need to opt for the Royal Indigo or Jade Green cards instead.

Every time I spend money (fiat or crypto) on my Crypto.com card, I will instantly receive 1% back, paid in CRO (Cronos). This is Crypto.com's native token, which I like to HODL, as I believe in the future growth of Crypto.com. If you don't wish to leave your cashback in CRO, you can easily convert it back to AUD or even any crypto of your choice, in a couple of clicks. For example, you can swap your CRO for BTC, ETH, USDT, or more.

Having used my Crypto.com card for a couple of years, I have received several hundred dollars of cashback in CRO. This could be worth much more in the future if the price of CRO shoots up in the next bull run.

Reimbursements on Popular Services

Owning a Crypto.com card also gives you 100% reimbursement on some services, and 10% on others. This will also depend on which tier of card you have, as the higher tiers come with more benefits.

Some of the reimbursements are:

- 100% on Spotify

- 100% on Netflix

- 100% on Amazon Prime

- 10% on Expedia

- 10% on Airbnb

These reimbursements are immediate, and all you have to do is pay using your Crypto.com card. After your purchase, you will receive the reimbursement paid in CRO. You can keep it as CRO, convert it to AUD, or convert to another cryptocurrency of your choice.

Keep in mind that the maximum monthly reimbursement for Spotify, Netflix, and Amazon Prime is $13.99 USD. To ensure you receive the full 100% reimbursement, ensure the AUD amount is less than $13.99 USD. Also, for Ruby Steel, Jade Green, and Royal Indigo cards, the reimbursements for Spotify and Netflix are only available for the first 6 months. When I first signed up for my card in 2021, it was unlimited, but Crypto.com changed the rules after a while. If you are on the higher tiers, you will receive 100% reimbursement on Netflix, Spotify, and Amazon Prime indefinitely.

Complimentary Airport Lounge Access

If you sign up for the Royal Indigo/Jade Green cards, you receive free airport lounge access at any participating international airport. If your card is a higher tier, you also can bring one guest free of charge to the lounge with you! This is a great perk, especially for those who are frequent travellers.

I personally only have the Ruby Steel card so I don't have access to this privilege, but my friend who has the Icy White card took me in as a free guest on our last holiday. We were flying out of Sydney International Airport and the lounge there was very nice. Free drinks (including alcohol), free hot food, and comfortable lounges where we could relax while waiting for our flight was a nice way to start the trip.

Easily Spend Your Crypto

If you're looking for a way to spend your crypto, the Crypto.com card is the answer. Simply load your card with crypto, straight from the Crypto.com app, and then you can use it to pay for anything you like. Your crypto will be automatically converted to AUD, so you don't have to manually sell your crypto before spending it.

With the digital Crypto.com Visa card, you can add it to your mobile wallet, eg: Google Pay, Apple Pay, or Samsung Pay, and tap at any merchant that accepts Visa. You can also use your physical card if you prefer. Making purchases online is also just as easy as using any regular debit or credit card. Enter your card details, expiry date, and CVV and you can spend your crypto using the Crypto.com card.

Withdraw Money from ATMs Around the World

With the Crypto.com card, you can withdraw fiat currency from ATMs in Australia, as well as around the world. This means if you are travelling, you can easily withdraw local currency using the AUD or crypto in your card. You can withdraw up to a certain limit for free each month, and this amount will depend on the tier of card you have. For my card (Ruby Steel), the limit is $400 AUD. If I exceed this amount in a month, there is a transaction fee of 2% which I find reasonable.

Crypto.com Card Tiers

There are 7 different Crypto.com Visa card colours available, but there are only 5 different tiers. This is because for two of the tiers, you can choose either of two colours as per your preference.

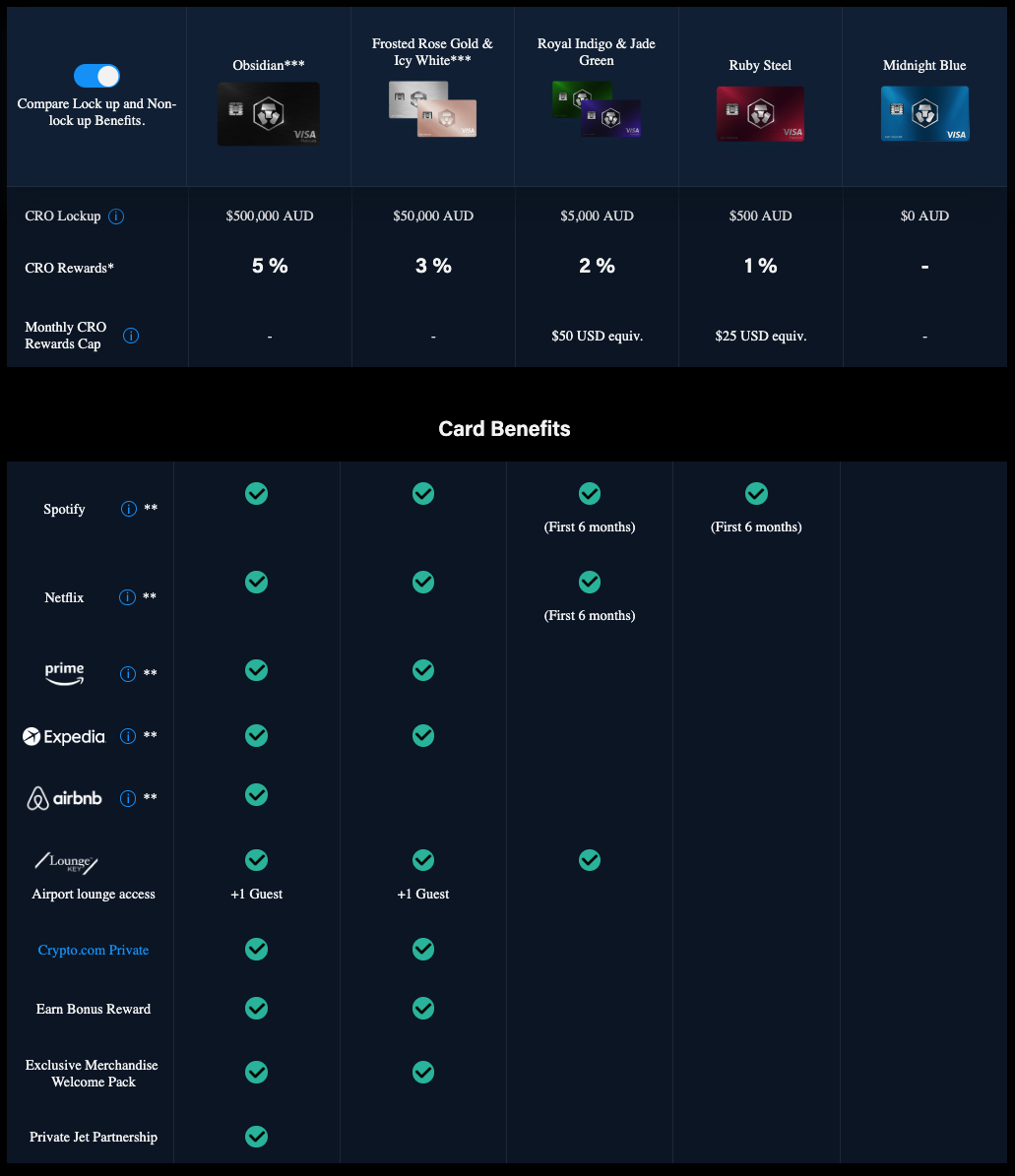

The different tiers are determined by how much CRO (Crypto.com's coin) you decide to stake for 180 days minimum. The higher the tier, the more CRO you need to stake, and the higher the cashback rewards and other benefits you will receive.

At the highest tier (Obsidian), you receive 5% cashback on all purchases, as well as FREE Spotify, Netflix, and Amazon Prime. There is also 10% cashback on Airbnb and Expedia, free airport lounge access (for you and a guest), and private jet partnership. However, to reach this tier, you need a whopping $500,000 AUD worth of CRO staked!

On the other end of the scale, you can apply for the Ruby Steel card (the one I have) for only $500 AUD worth of CRO. Remember, it doesn't mean you are paying $500 for the card. You are paying $500 for CRO, which you are staking for at least 180 days. The CRO is still yours, and after the 180 days, you can choose to sell your CRO, or convert it to another cryptocurrency. But you must note that if you stop staking your CRO, you will lose benefits that come with your card, such as the crypto cashback. The benefits of the Ruby Steel card are 1% cashback in CRO, as well as free Spotify for 6 months.

See the table below for all the tiers and their associated benefits and cashback:

My Personal Experience with Crypto.com Card

My experience the Crypto.com card dates back to late 2021, when it first became available for Australians. I will run through various aspects of the card, and focus on some positives and negatives of using the card.

Crypto.com Card Application

Beginning the application for the card was straightforward, using the Crypto.com app. I had to register for an account with the app first, then navigate in the menu to the 'Apply for Crypto.com card' section.

Based on your preferred card tier, a specific amount of CRO coins must be bought and staked. Since I opted for the Ruby Steel card, it required only $500 AUD of CRO. After purchasing the required amount of CRO, I had to stake it for the obligatory 180 days as a condition for the Crypto.com card application.

ID Verification and Card Approval

The next step included verifying my address and identity by uploading relevant documents such as a driver's license and utility bills. After promptly submitting my documentation, it took just over a week for approval. Keep in mind that this duration will vary depending on Crypto.com's workload. Anecdotally, the approval period ranges from 1-2 weeks based on feedback from colleagues, friends, and other users.

Delivery of Crypto.com Card

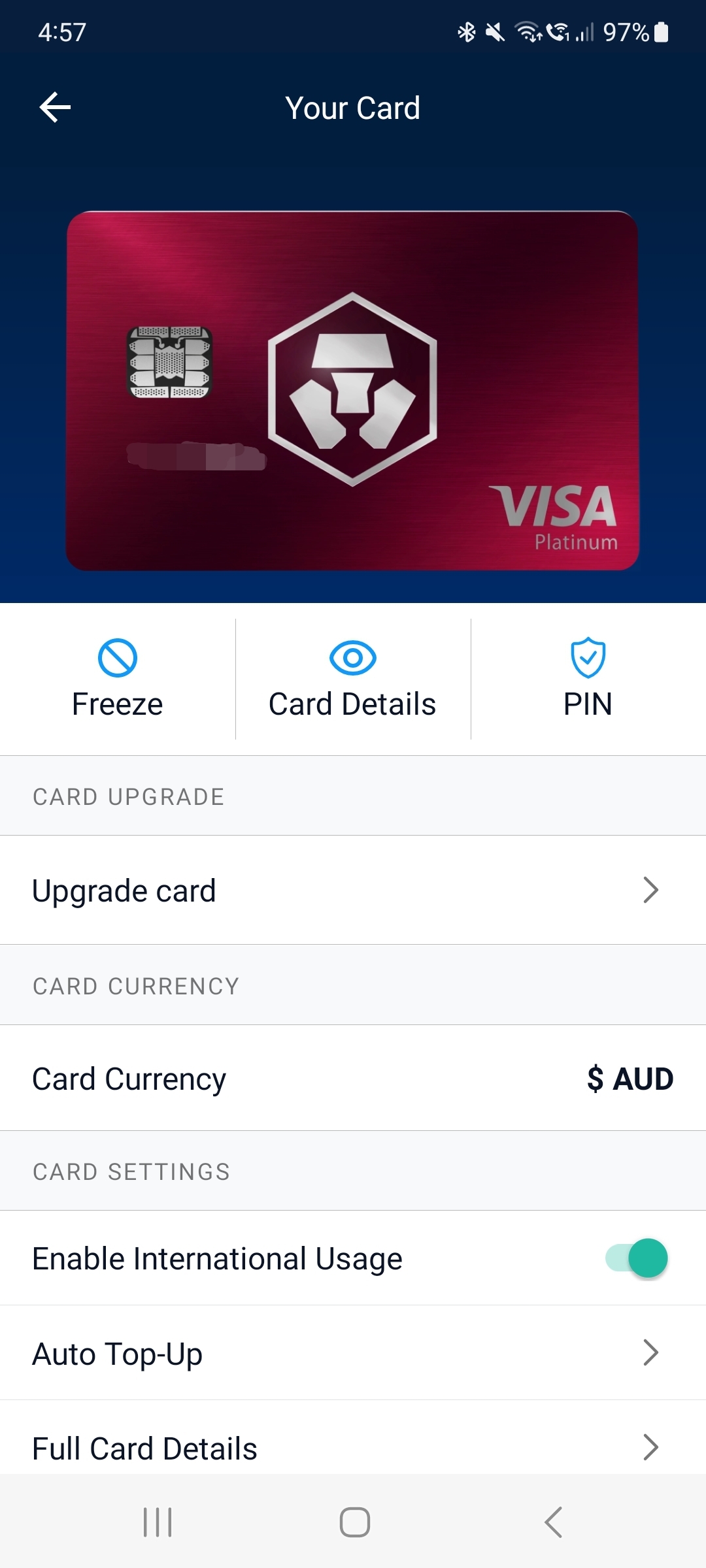

After my application was approved, I was granted immediate access to a digital version of my card, which came in handy for online transactions. Additionally, I registered my card with Google Pay for convenient Visa payments in brick-and-mortar stores.

It took about 4 weeks for the physical card to arrive, but take into account that this includes international shipping to Australia. The card is a beautiful piece of metal, that has a satisfying weight to it. It is nice to look at and hold, but since I do all my payments using Google Pay, I don't carry it around with me. If you signed up for a higher tier card, you may want to bring the card with you when travelling, as you need to show it to receive complimentary airport lounge access.

Adding Funds to Crypto.com Card

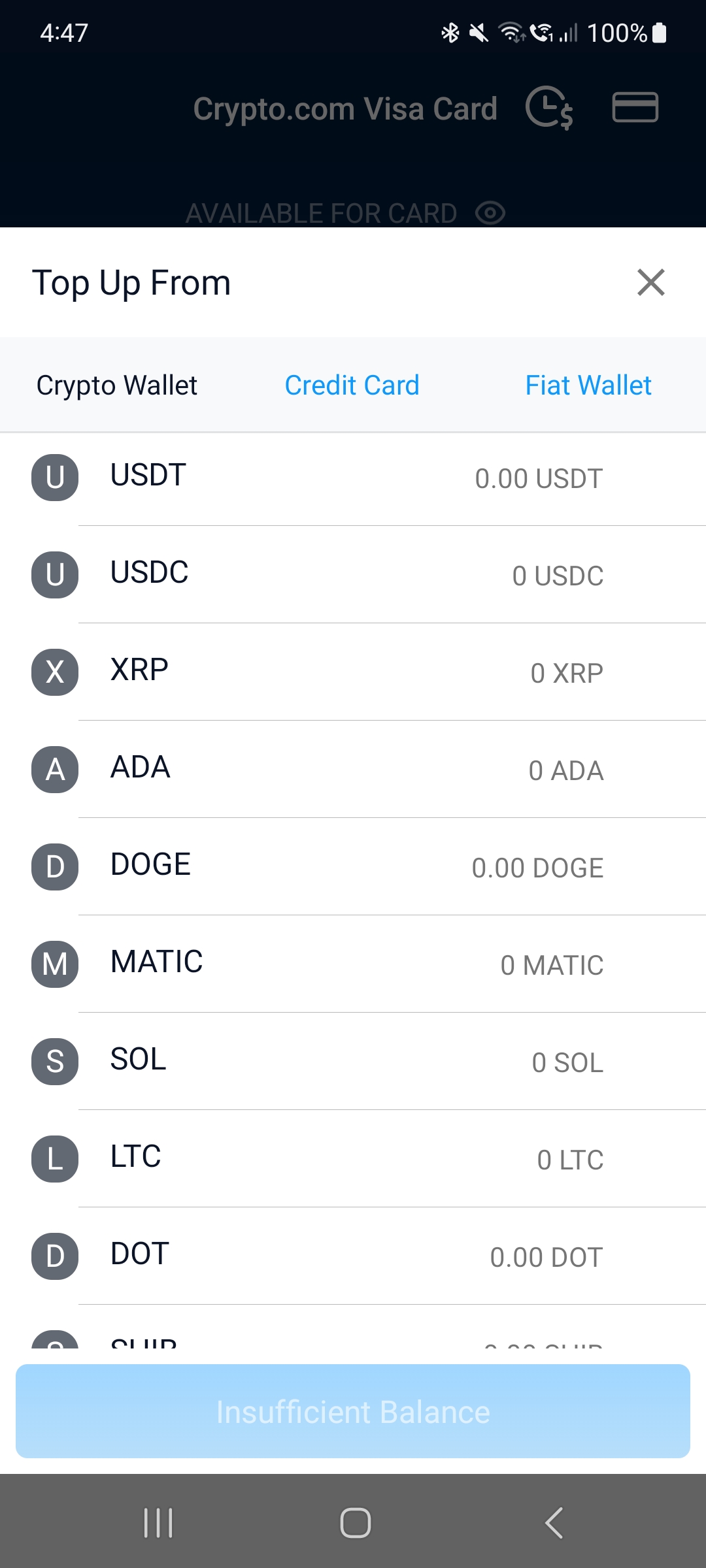

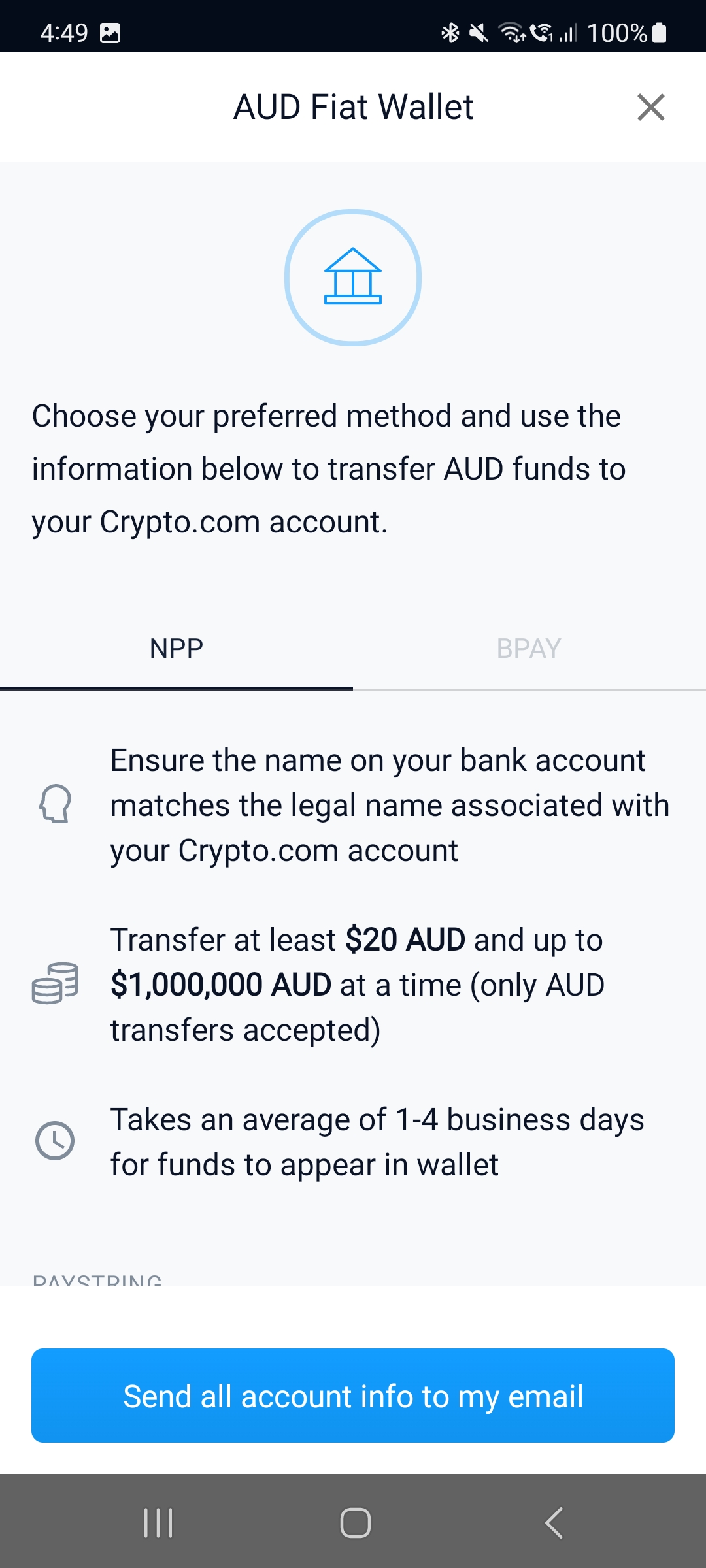

This step is an effortless process. Within the app, navigate to the card and hit the 'Top Up' button. You will then see several options to load the card, including using cryptocurrency, a credit card, or fiat currency.

I've tried each of these methods and can vouch for their seamless operation. When topping up with fiat currency, you must first deposit AUD into your Crypto.com account. While Crypto.com app states that NPP can take up to 4 business days, in my experience, the transfers are always completed in just a few minutes.

Using the Crypto.com Card for Payments

Ever since receiving the Crypto.com card, it has been my go-to for online payments, requiring only the card's number, expiry, and CVV details, just like any regular debit or credit card.

For physical store purchases, I rely on Google Pay with my Crypto.com card. It's incredibly convenient as I don't need to carry my card or wallet. The physical card, of course, can also be used in-store if preferred.

Getting CRO Cashback

Upon completing a purchase, the Crypto.com app notifies me right away of the amount of CRO cashback received, along with the equivalent USD value. This is automatically added to my CRO wallet within the app without requiring any additional actions. I usually let my cashback sit as CRO, waiting for its future growth. However, you have the option to convert your CRO into AUD or other cryptocurrencies at your discretion.

As mentioned earlier, when I first received the Ruby Steel card, the cashback level was 2%, but unfortunately after a few months, Crypto.com reduced this to only 1%. Keep in mind that they reserve the right to adjust their rates at any time they like. Having said that, it has not been reduced any further in more than a year.

Also, it's important to note that some payments will not give you cashback, for example paying for bills or insurance. For whatever reason, you won't be able to receive CRO when you make these payments.

Exploring Crypto.com Card Benefits

Other than enjoying 1% cashback on my purchases, I took advantage of the 6-month free subscription for Spotify. This is great because I already used Spotify before signing up to Crypto.com, so essentially I was receiving free crypto for money I would have spent anyway. To receive the reimbursement, you must use your Crypto.com card as the payment method for the subscription. The available amount per month that can be claimed is 1 payment, up to $13.99 USD.

While my Ruby Steel card doesn't give me complimentary access to Airport Lounges, my friend has the Icy White card and I have been taken in as his guest for free. All it takes is showing the card to the Lounge staff to savour free food and drinks! If you sign up for Royal Indigo/Jade Green or any higher tier, you will receive complimentary access to Airport Lounges globally!

My Overall Verdict

Using my Crypto.com Visa card has been rewarding as it enables the growth of my cryptocurrency portfolio with every transaction. Even though 1% cashback might not seem like much, it can accumulate substantially over time. Coupled with potential CRO value appreciation, this could translate into significant growth.

The card's ease of use is commendable, and the absence of sign-up fees, annual fees, or transaction charges (unless withdrawing from an ATM post reaching your monthly limit) is a big plus. The sole drawback is the requirement to keep your CRO staked for a minimum of 180 days to enjoy card benefits. After this period expires, while you can withdraw your CRO and continue using the card, your cashback and benefits will be scaled down.

Crypto.com Visa Card Fees

Card Application Fee

It does not cost any money to apply for the Crypto.com card.

Annual Fee

The Crypto.com card does not have any annual fee.

Transaction Fee

There are no transaction fees to use the Crypto.com card. However, if you load your card using cryptocurrency, your crypto will be converted to AUD, and Crypto.com will make money through the spread.

ATM Fee

Each tier of card will have a limit of free ATM withdrawals per month, as shown below. After reaching these limits, the fee to withdraw from an ATM is 2% per transaction.

Obsidian, Frosted Rose Gold, Icy White: $1,000 AUD

Jade Green, Royal Indigo: $800 AUD

Ruby Steel: $400 AUD

Midnight Blue: $200 AUD

Card Upgrade Fee

If you want to upgrade your card, the first step is to stake the necessary amount. In my case, I have the Ruby Steel card, which requires $500 of CRO to be staked. If I decide to upgrade to Royal Indigo, I need to stake $5,000 total. After I do that, I can upgrade to Royal Indigo tier, but continue to use my current Ruby Steel card. I will still be able to enjoy the increased cashback and other perks, but I won't get a new Royal Indigo physical card, unless I pay $50 for it.

Fee to Replace Lost/Stolen Card

Midnight Blue card: $7

All other cards: $50

Account Closure Fee

If you no longer wish to use your Crypto.com card, you can close your account for free as long as you no balance remaining on your card.

If you have funds on your card, you can withdraw it from an ATM, or spend it. Otherwise, you can pay a $50 processing fee to Crypto.com to return your funds to you manually.

CRO Staking Requirement

Apart from the Midnight Blue tier, you need to meet certain CRO staking requirements in order to receive a Crypto.com card. The amount ranges from $500 up to $500,000, depending on which tier of card you want. Click here to see the staking requirements for all the tiers.

Conclusion

Overall, I would recommend the Crypto.com card to anyone that believes in the future of crypto. If you do, then Crypto.com card is the perfect to keep gradually growing your crypto portfolio, without having to put any thought or time into it. Simply make purchases with your card (with AUD or crypto), and you will get cashback immediately into your wallet on your Crypto.com app.

The one major consideration is whether you wish to keep CRO staked, as this is a requirement to receive a Crypto.com card, and enjoy the cashback and benefits on an ongoing basis. To read about Crypto.com before deciding on the card, you can read my comprehensive review here.