Most crypto exchanges use KYC (Know Your Customer) guidelines to prevent their platforms being used for money laundering. However, many crypto investors prefer to use a crypto platform that has no KYC, in order to remain anonymous. I have used and reviewed crypto exchanges in Australia for more than 7 years and I have created this list of the best no KYC crypto exchanges.

What is KYC?

KYC stands for 'Know Your Customer', and these guidelines refer to a financial institution’s obligation to conduct certain background checks before you can use its product or platform. In most cases, it requires you to provide identification documents before you are allowed to trade or buy crypto.

Why do people want to avoid KYC?

There are numerous reasons why people may want to to avoid KYC. Some users are wary of giving out their personal information online, or they believe that identity verification goes against the idea of anonymity in crypto trading. Others may want to evade tax, or trade crypto illegally (eg: they may be underage or in a country where crypto is banned). I do NOT recommend using no KYC exchanges for illegal activity; if you are considering this, be aware that there may be heavy penalties for illegal activity such as money laundering, and crypto exchanges can request KYC at a later point if they suspect there is any criminal or illegal activity.

If you want to trade or buy crypto without KYC for legitimate reasons, then continue reading as I show you the best options in Australia.

The Best No KYC Cryptocurrency Exchanges in Australia - Tested and Reviewed in 2024

When I compile these lists, I base my results on rigorous testing and personal experience. I continually review and research exchanges over time, and frequently update these posts to ensure you have the most useful and accurate information in 2024.

- 1Bybit - Best No KYC crypto exchange in Australia

- 2MEXC - Most trading pairs (over 2,110+)

- 3Kine - Best DEX (decentralised exchange)

- 4Margex - Best No KYC margin trading platform

- 5KuCoin - Huge range of 700+ coins

- 6Bisq - No KYC decentralized Bitcoin exchange

- 7Bitfinex - Best No KYC crypto derivatives trading platform

- 8PrimeXBT - Up to 100x leverage

- 9AAX - Advanced features and easy to use

Best No KYC Crypto Exchanges in Australia - Reviews

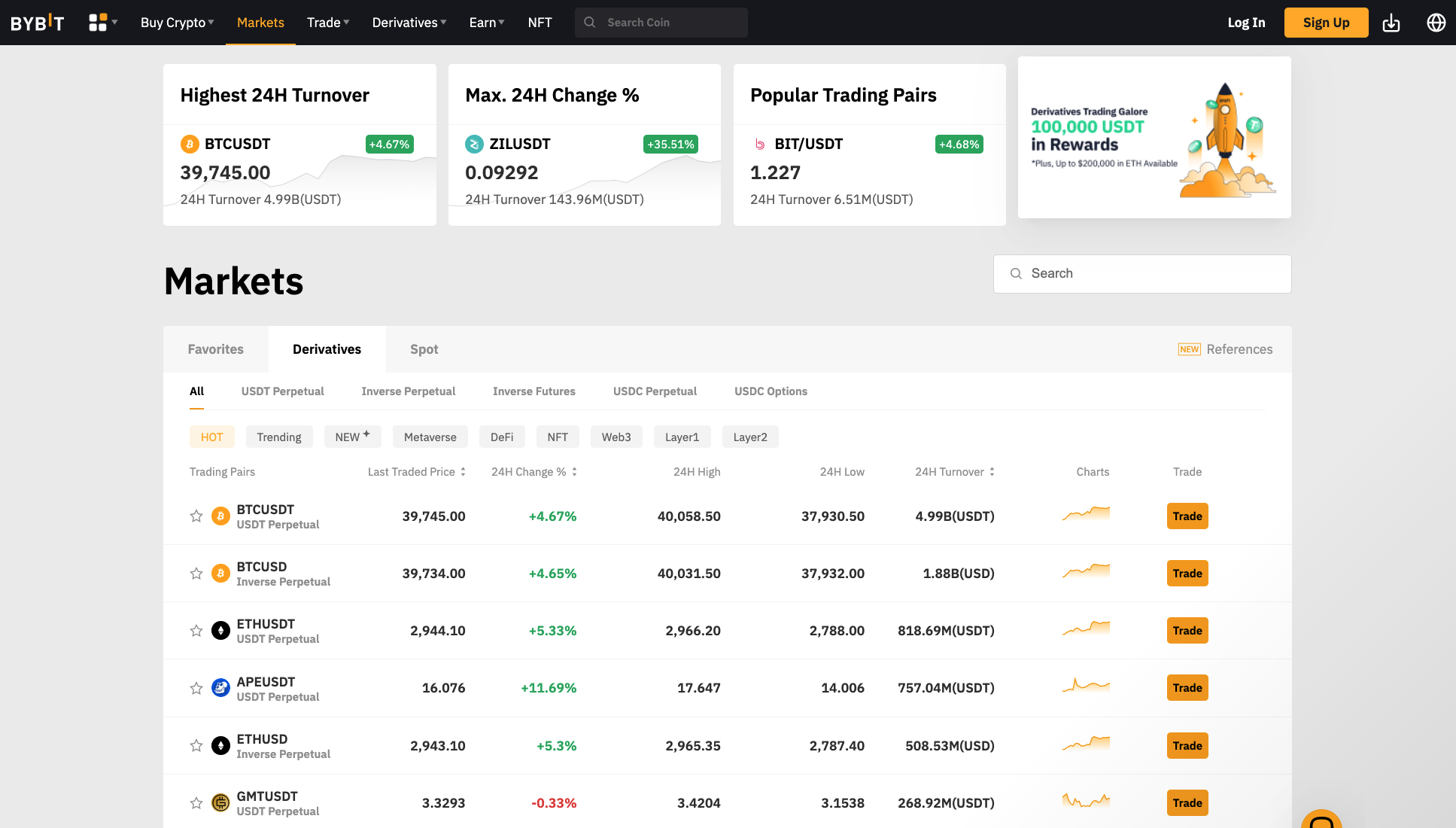

#1. Bybit – Best No KYC crypto exchange in Australia:

Trading fees: Spot trading: 0.1%, Derivatives trading: Makers 0.01% / Takers 0.06%

Coins: 280+

Founded in 2018, Bybit is a well-known Singaporean exchange, that has more than 10 million users worldwide. It offers many great features, hence the popularity, and is especially good for margin trading. Bybit offers leverage of up to 100X on Bitcoin and up to 50X on all other trading pairs.

Bybit offers some great features such as one-click coin swaps and a very intuitive user interface. Bybit also has an advanced security system so you can trade with peace of mind. Their trading fees are 0.1% for spot trading, and very low for derivatives trading (0.01% for makers, 0.06% for takers). It also supports different languages, and has mobile apps for both iOS and Android systems.

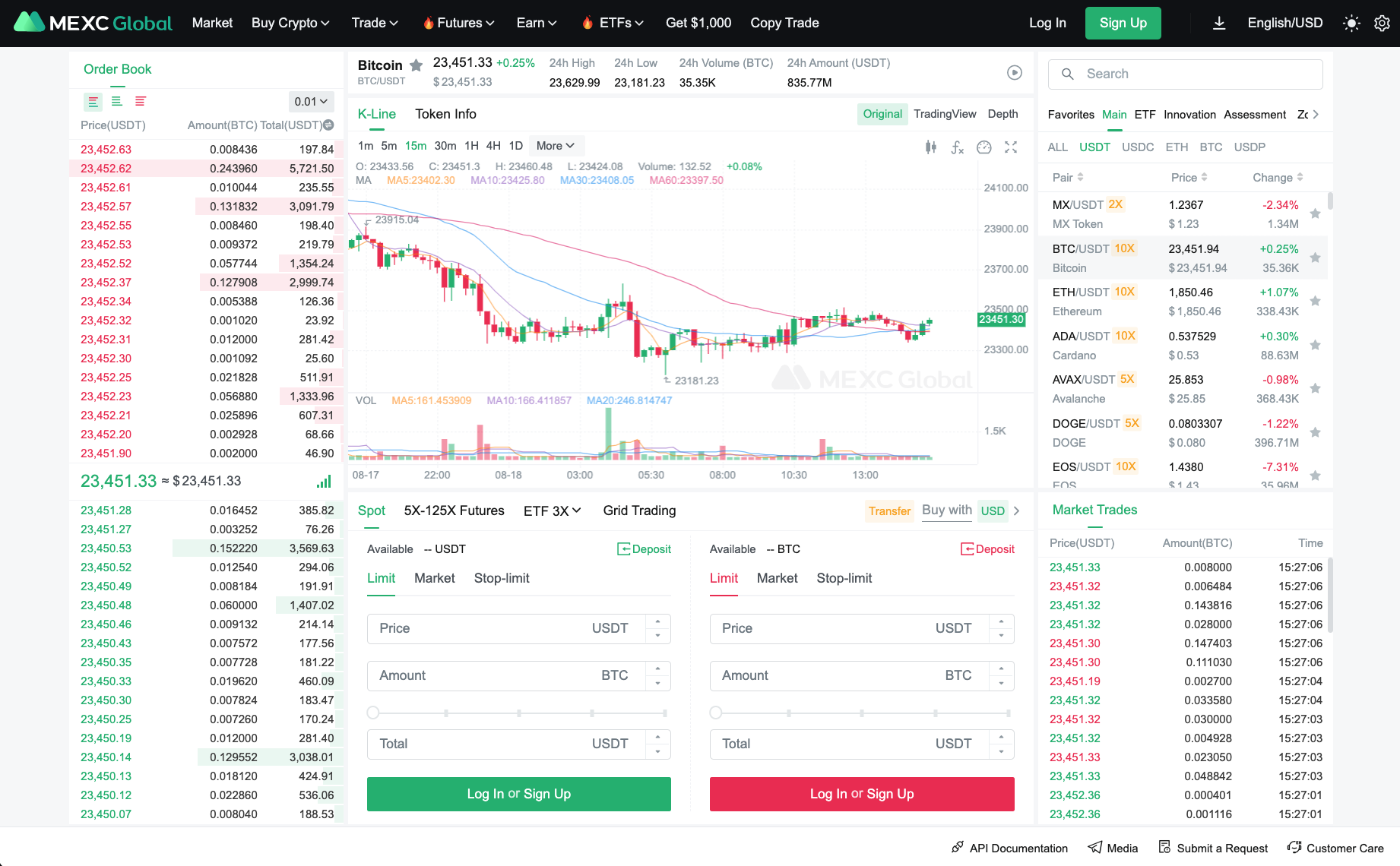

#2. MEXC – No KYC crypto exchange with 2,110+ trading pairs:

Trading fees: Spot trading: 0.1%, Futures trading: Makers 0.01% / Takers 0.05%

Coins: 1,520+

MEXC is one of the world's largest crypto trading platforms, and it is well known for its massive range of more than 1,520+ coins and 2,110+ trading pairs. This is the most available on the market, and the trading fees are also very low, at 0.1% for spot trading and only 0.01%/0.05% for futures trading.

MEXC also offers a range of other features, such as staking, leverage trading (up to 200x), premium customer support, and instant purchasing of crypto. There are various payment methods accepted on MEXC, such as Visa/Mastercard, bank cards, bank transfer, Apple Pay, and Google Pay.

If you want to try out MEXC, be sure to use my link here, which gives new users $30 FREE USDT, plus a discount of 10% off all trading fees on your account.

#3. Kine – Best decentralised exchange (DEX):

Trading fees: Derivatives trading: 0.05%

Coins: 21

Kine is my top recommendation for a decentralised no KYC exchange. It is focused on derivatives trading, with a low fee of 0.05%, and is perfectly suited for large volume traders. Since Kine operates on a peer-to-pool mechanism, they have unlimited liquidity and low slippage. All trades are filled instantly, with less than 1% slippage.

Kine also stands out from other DEXs as it provides users with zero gas fee trading! While other DEXs require a trader to pay gas fees on their transactions, Kine has gotten rid of this altogether. This is made possible because of the Layer 2 Network they use.

If you are a newer investor, or simply don't have time to watch the markets all day, you can use Kine's copy trading feature. This is where you follow a professional trader, and Kine will automatically place the exact same orders as them. You can profit alongside the successful trader, relying on their experience and knowledge. This is an excellent feature for understanding how to trade, as well as making profits without having to stay online.

Kine also offers an excellent welcome offer to those who sign up with this unique link. You receive 10 USDT bonus when you deposit $200, and 50 USDT bonus when you deposit $1,000. If you make a deposit of $5,000, you receive a massive 8,000 USDT in bonus!

#4. Margex – Best No KYC margin trading platform:

Trading fees: Makers 0.019% / Takers 0.06%

Coins: 18

Margex is another great platform that hasn’t introduced KYC guidelines and has some great features to offer. It was founded in 2020, and although relatively new, it offers up to 100X leverage for all trading pairs.

One of the great things about Margex is that it is equipped for beginners to margin trading. It has a very intuitive, easy-to-use interface, and a wide range of reading materials and guides to help beginners attain a profit. It also requires a deposit of only $10 and supports 18 cryptos, including BTC, ETH, and other popular coins.

Another thing to note is that Margex offers low 0.019% maker and 0.060% taker fees for all trading pairs.

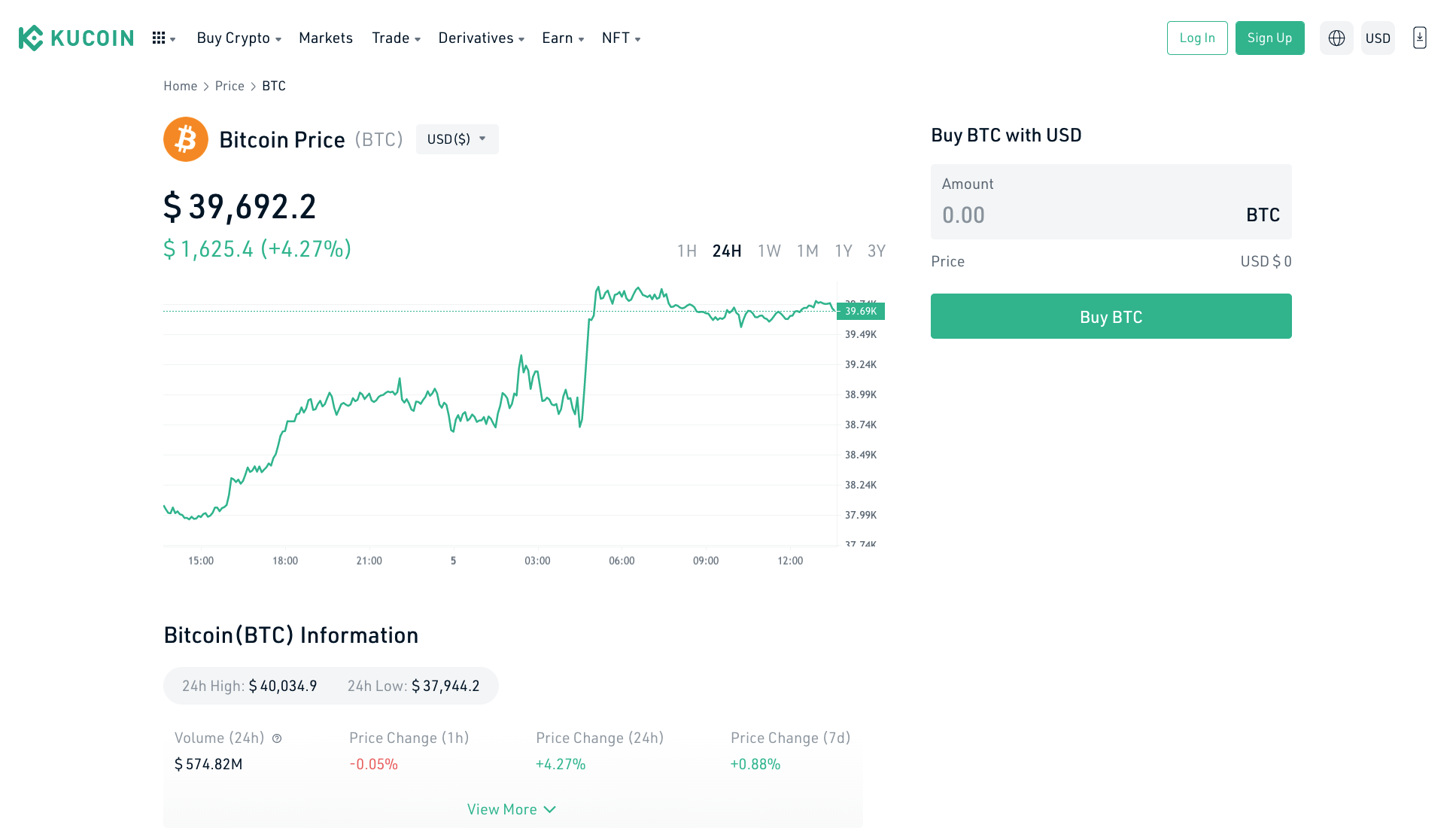

#5. KuCoin Exchange – Huge range of 700+ coins:

Trading fees: Spot trading: 0.1%, Futures trading: Makers 0.02% / Takers 0.06%

Coins: 700+

KuCoin is a great No KYC alternative to the world's largest trading platform, Binance. It offers a huge range of 700+ coins, like Binance, and tons of trading markets, at a low fee of 0.1%. Signing up and trading on KuCoin will not require KYC, but if you want to trade more than 2 BTC per day, you will need to complete identity verification first.

The platform offers various great features for both entry-level and experienced traders and allows you to do margin and spot trading, staking, crypto lending, mining pools, and more. With a $100 million daily trade volume and investments from IDG Capital and Matrix Partners, it is a very popular and trusted platform. It is easy to get started on KuCoin and you can even use their free trading bots to automate your strategy while you are away from the computer.

For spot trading, fees are only 0.1%, and for futures trading, fees are 0.02% for makers and 0.06% for takers. If you opt to pay your fees using KuCoin's own token (KCS), you receive 20% discount. KuCoin has a withdrawal limit of 5 BTC per day without KYC, but it increases to 100 BTC if you decide to verify your account.

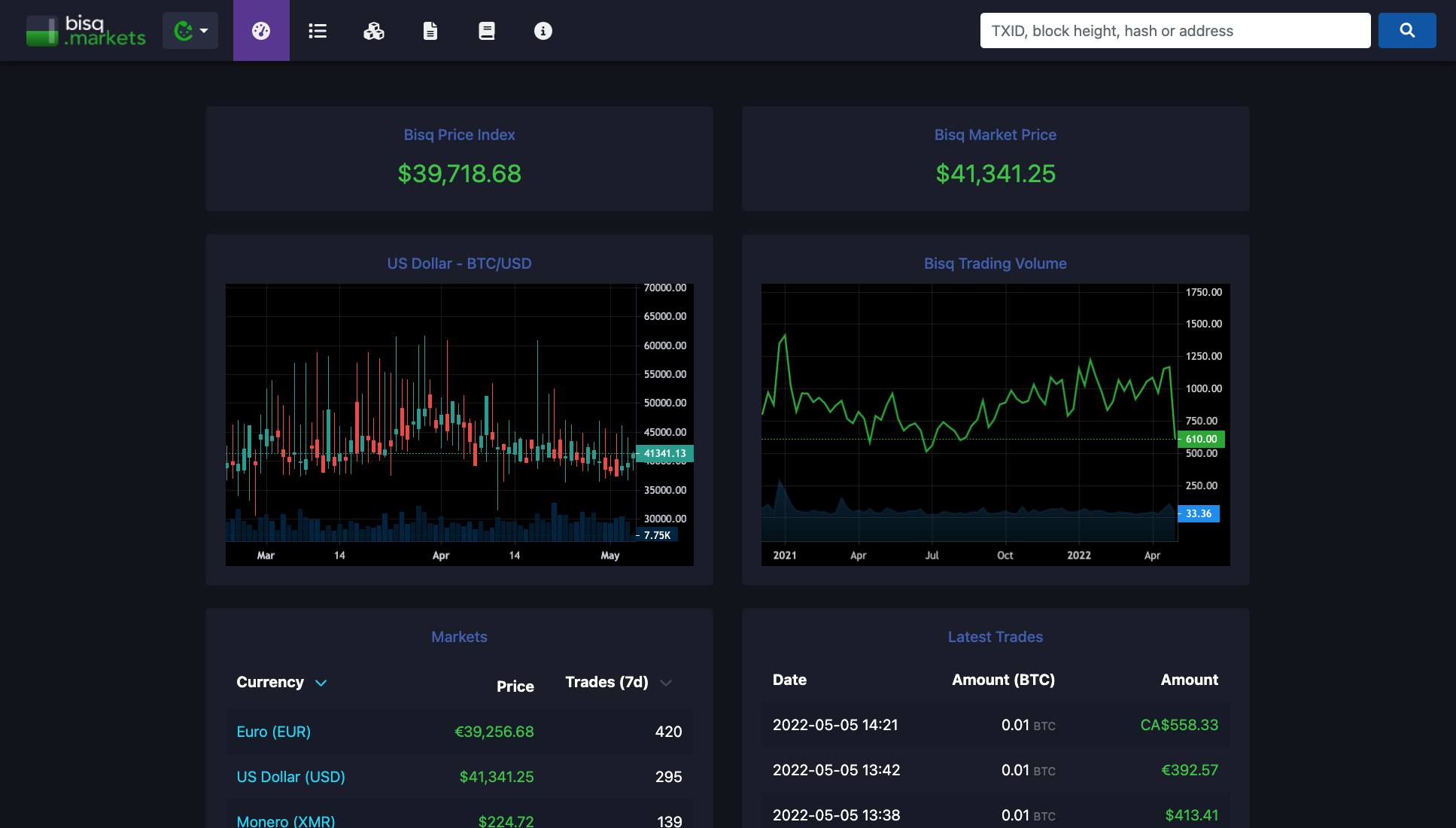

#6. Bisq – No KYC decentralized Bitcoin Exchange:

Trading fees: Makers 0.05% / Takers 0.35%

Coins: 125+

Also known as BitSquare, this is the world’s only fully decentralized platform where you don’t have to enter your personal details, including your name and email address. Although it might be a bit difficult for beginners, the upside of BitSquare is security, since it uses Tor and doesn’t keep fiat or Bitcoin on the server.

There are a couple of things that we really like about BISQ. For example, it supports over 15 different payment options and 126 different coins, and there is also easy-to-use software that you can download.

You can only trade against BTC on Bisq and there aren’t many learning materials, which makes BISQ not an ideal choice for beginners.

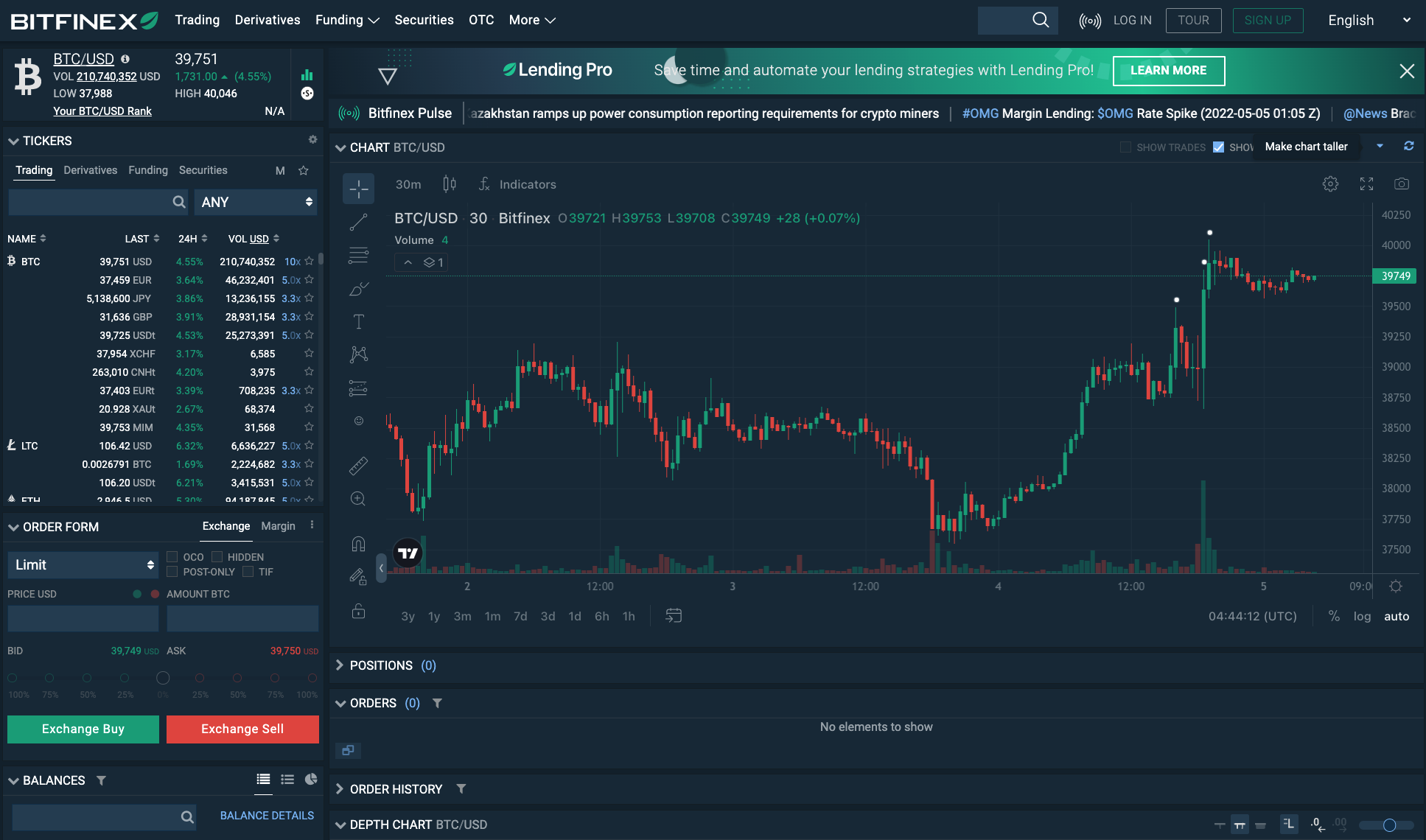

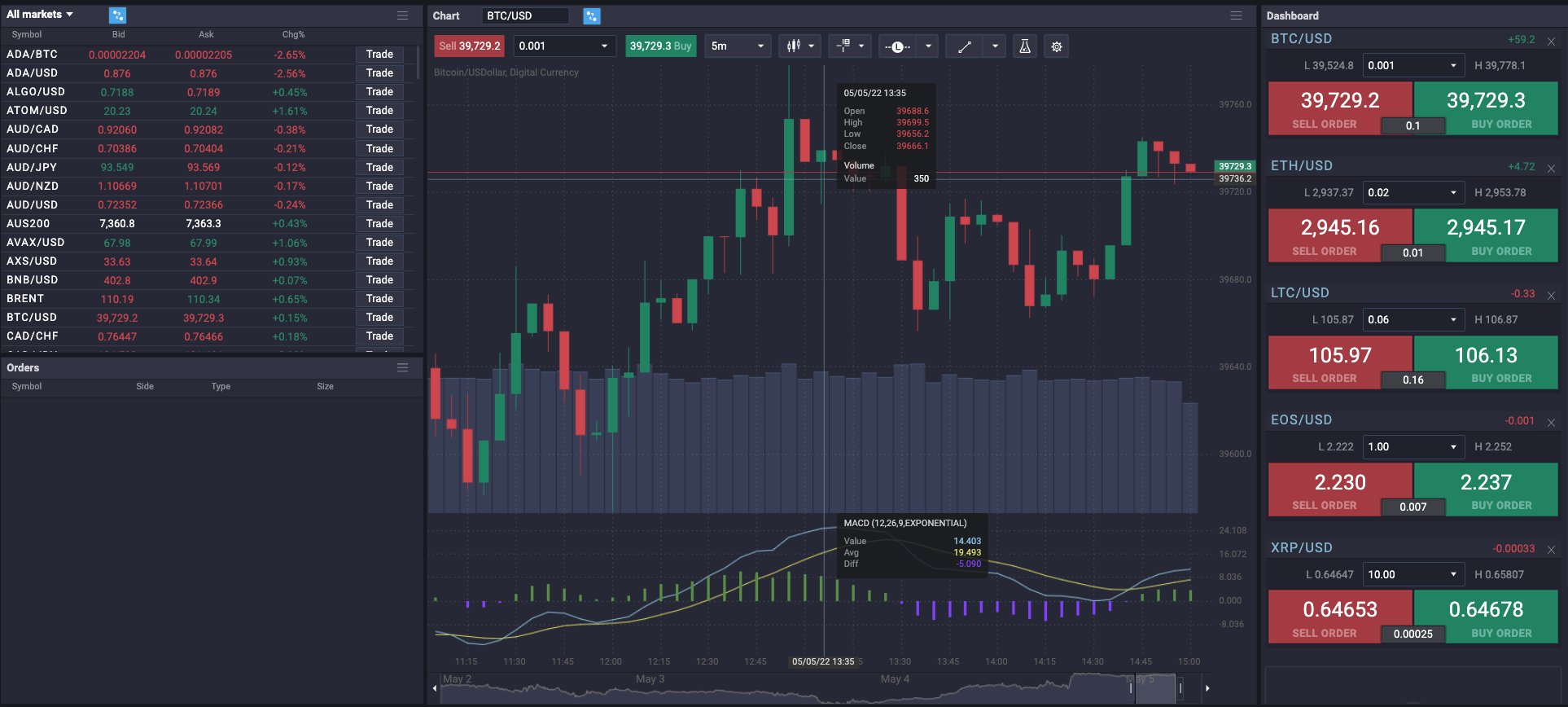

#7. Bitfinex – Best No KYC crypto derivatives trading platform:

Trading fees: Spot trading: Makers 0.1% / Takers 0.2%, Derivatives trading: Makers 0.02% / Takers 0.075%

Coins: 150+

Bitfinex is another great No KYC exchange with over 10 years in the market, popular for offering the deepest liquidity order books and top-notch customer support. It allows you to perform a wide array of functions, such as trading, funding, derivatives, securities, margin trading, and more.

With high liquidity, it is a great choice to exchange BTC, ETH, XRP, and other popular coins. Another great thing about Bitfinex is its interface. It is customisable and allows you to choose between different themes and layouts, and you can also set up notifications.

When it comes to fees, they are 0.1% / 0.2% (maker/taker) for spot trading, and 0.02% / 0.075% (maker/taker) for derivatives. There is also a withdrawal limit which is 2 BTC, but you can increase it to 100 BTC with KYC.

Bitfinex offers over 150+ coins and 300+ trading pairs so you will have plenty of options to choose from when trading.

#8. PrimeXBT – Up to 100x leverage:

Trading fees: Free

Coins: 40+

Found in 2018 in Seychelles, PrimeXBT has become one of the best crypto platforms in just a few years. One of the top features of PrimeXBT is that it allows one of the highest leverages (100x) among popular platforms.

The interface is customisable and even supports advanced indicators and chart types, which makes it a good choice for both entry-level and experienced traders. It offers over 40+ different cryptocurrencies, as well as other markets, such as forex, commodities and indices.

Trading fees on PrimeXBT are 0.05%, but note that all crypto trading on this exchange is margin trading using CFDs only. There is no spot trading supported.

#9. AAX – Advanced features and easy to use:

Trading fees: Spot trading: Makers 0.1% / Takers 0.15%, Futures trading: Makers 0.04% / Takers 0.06%

Coins: 100+

AAX is another great No KYC exchange used by over 2 million investors. AAX is unique in that it offers plenty of advanced features, but remains user-friendly, making it excellent for beginners. It is powered by the popular LSEG Technology which offers incredibly fast transactions.

AAX supports over 100+ cryptocurrencies and more than 20 fiat currencies, which is a decent number. Trading fees are low at 0.1/0.15% (maker/taker) for spot trading, and 0.04/0.06% (maker/taker) for futures trading. However, liquidity can be low on this platform, and their mobile app needs some improvements.

If you choose not to submit KYC documents, your maximum daily withdrawal limit is capped at 2 BTC. To access a higher withdrawal limit of 100 BTC per day, you need to verify your identity.

These are the best crypto trading platforms without KYC requirements, and you can’t go wrong by choosing any exchange from the list. However, keep in mind that some exchanges may request KYC at some point, especially if they sense any suspicious activity. We will remind you again, make sure you do NOT use crypto exchanges for illegal activities, such as money laundering.

Feel free to read our privacy policy click the link.