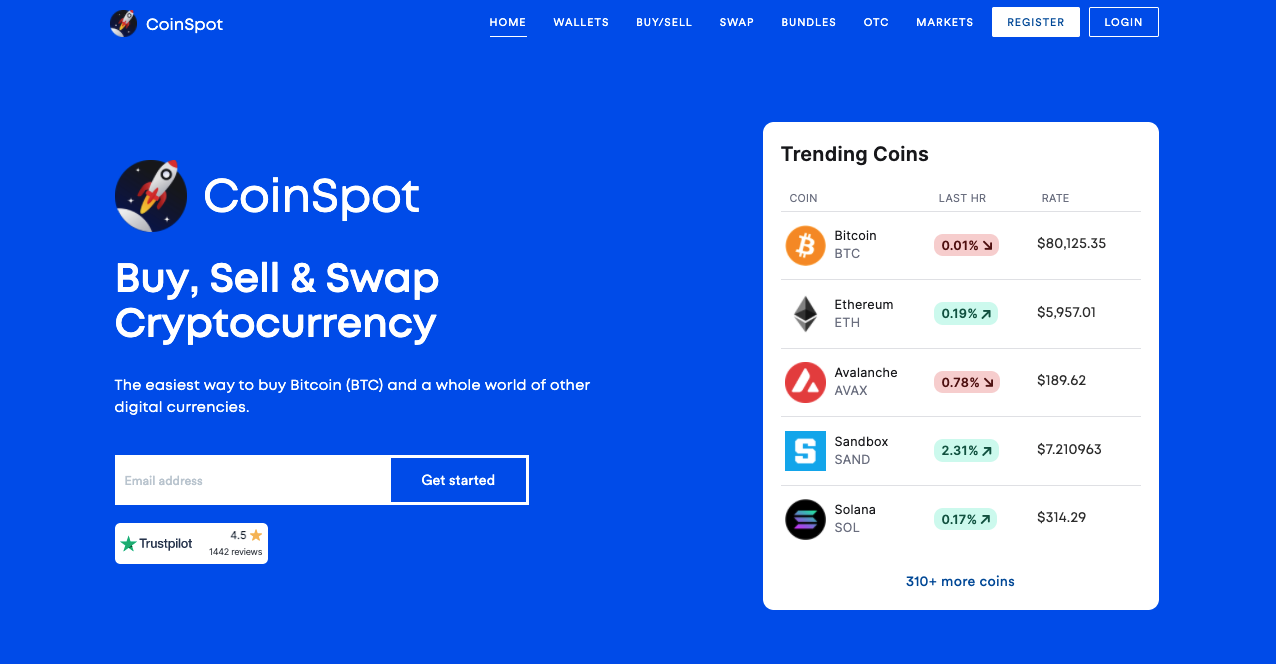

Starting out in cryptocurrency presents more than a few challenges. Beginners may not have any idea how to get started, which is why we have reviewed CoinSpot, Australia’s most trusted crypto exchange site, which is perfect for newcomers. They have 10 years' experience, boast over 2.5 million valued customers, and they are the most secure crypto exchange in Australia.

CoinSpot was one of the first Australian cryptocurrency sites, and they’ve built their reputation by serving the Australian crypto investor. That’s a big reason why I was so keen on this review, to see what has made them so successful for so long. I have also secured a special offer for my readers: $20 FREE Bitcoin when you sign up with this link.

What is CoinSpot?

While cryptocurrency has no borders, a cryptocurrency exchange still needs to understand their target market, and that’s where CoinSpot has thrived, catering to Australians from the beginning.

- Award-winning safety, with customisable security features

- $20 FREE Bitcoin promo bonus when you sign up with this link

- Assets stored securely offline for additional security

- A member of the Australian Digital Commerce Association (ADCA)

- OTC services for high-volume traders

- 4.4 stars on Trustpilot, based on over 1,900 reviews

- Over 410+ cryptocurrencies supported, including BTC, ETH, LTC, BNB, ADA

- Deep network of over 2.5 million customers

- Mobile app available

- 24/7 Live Chat Customer Service

Features

Experience and Reach

CoinSpot has built their reputation on providing a platform that’s as easy for the beginner as for the seasoned pro. And it’s as rewarding for both groups, as well.

One of the first features that CoinSpot offers is simply their experience. Whether it’s a trusted mechanic or a family doctor, having a good reputation is invaluable in any business. CoinSpot has grown into one of the oldest and largest cryptocurrency exchange sites in Australia, and they’ve done it while maintaining the highest standards of security and performance.

Number of Cryptocurrencies

Having been in cryptocurrency for so long, and having developed such a large customer base, CoinSpot has delivered an amazing feature they call their CoinSpot Markets. Here you can trade directly with any of the other 2.5 million CoinSpot customers for an astonishingly low 0.1% trading fee. That means you’re not only getting the benefit of access to the largest customer base for crypto exchange, but you can do it for the lowest trade rate we’ve seen in Australia.

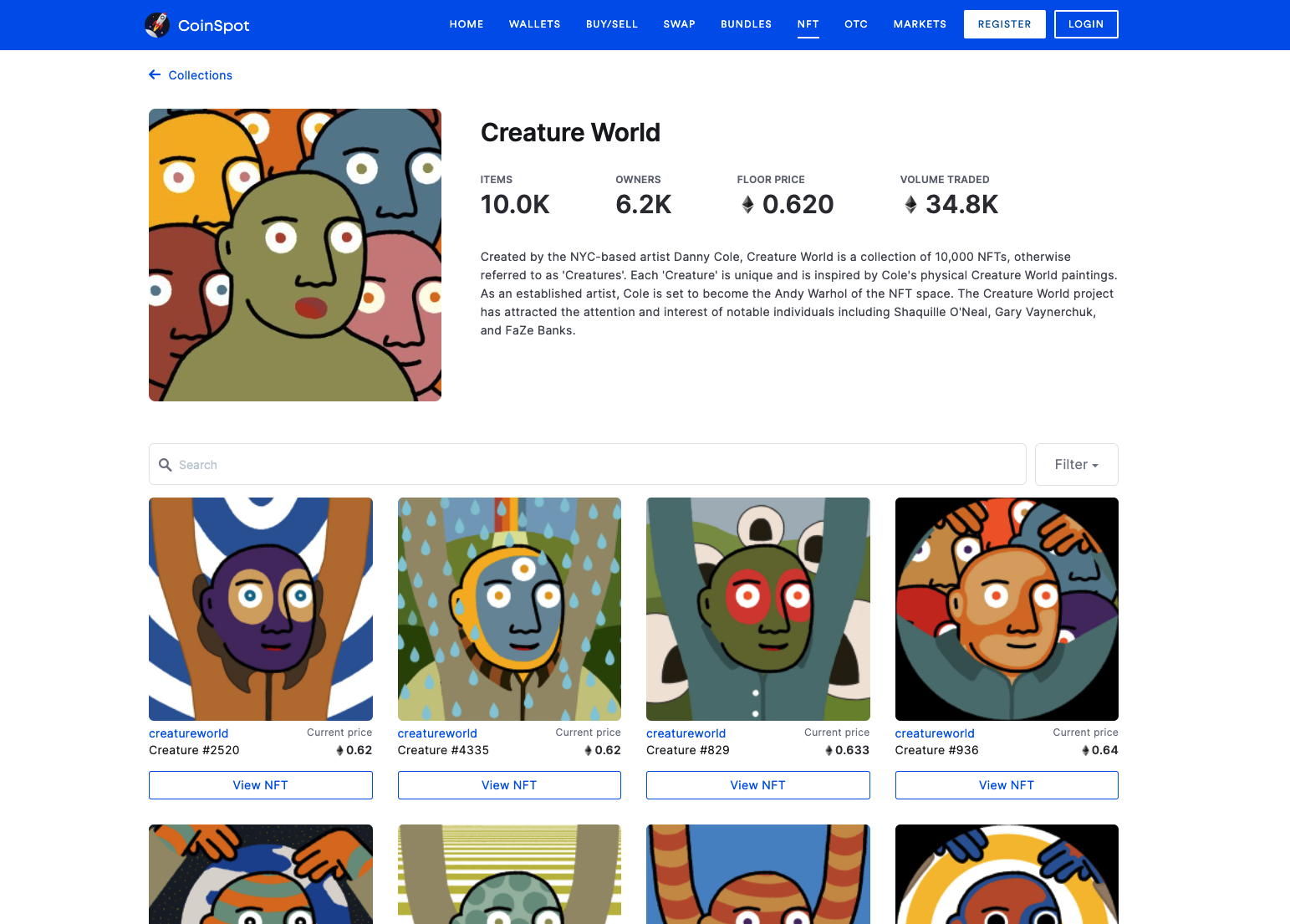

Buy and Sell NFTs

CoinSpot has introduced an NFT Marketplace where you can buy and sell NFTs. Everyone is talking about NFTs these last few years, and whether you believe in them or not, they are definitely here to stay. Easily buy your own NFT using any cryptocurrency in your CoinSpot account. No need to muck around on OpenSea or link an external wallet. CoinSpot makes NFTs easy for everyone.

Perfect for Beginners

For new crypto investors, all of these new terms can be a little daunting. If that’s the case for you, CoinSpot can help you. Through their social media channels, you can join the conversation with CoinSpot's 2.5 million customers, so you’re not going through it alone. CoinSpot also has excellent Live Chat customer service available 24/7 that can help you through any of your problems.

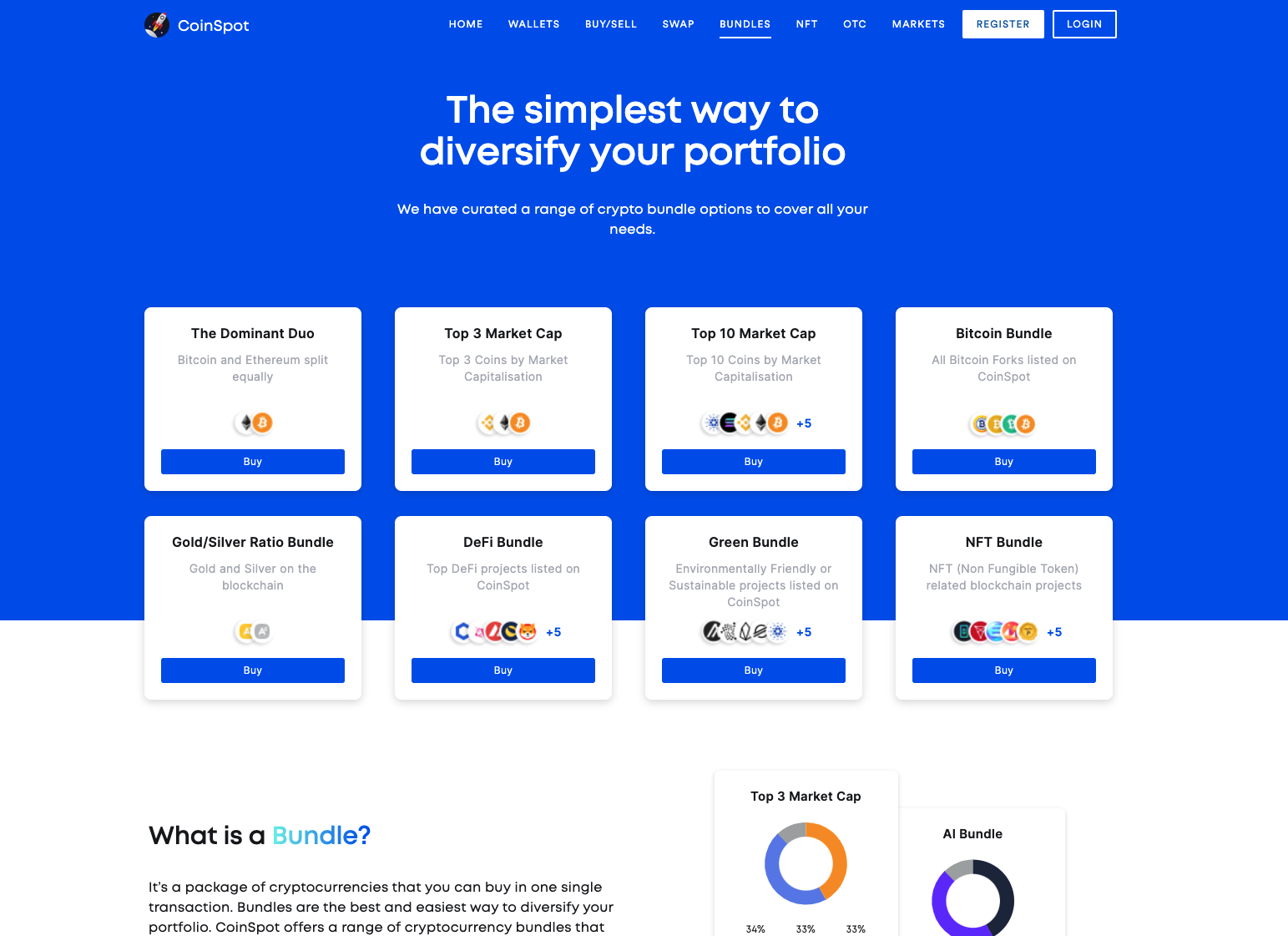

Bundles

If you’ve been trading crypto for a while, you may already have an idea of which cryptocurrencies you want to invest in. On the other hand, if you’re new to cryptocurrency, you may want to take advantage of CoinSpot's bundles. You can think of the bundles like the S&P/ASX 200 for traditional stocks. If you’re unsure about which one coin to invest in, or if you want a diverse portfolio to protect against risk, then CoinSpot’s bundles are for you.

They list 10 bundles on their website at the time of writing, and the list includes investing in all the Bitcoin offshoots, or investing in coins that relate to the supply chain. Buying in a bundle not only offers you the safety of diverse investments, but you can save money on the fees by only paying one fee for the whole bundle instead of paying each fee separately (in some cases ten at a time).

Once you’ve gotten the hang of investing, CoinSpot also gives you the option of sorting investment options by type of coin. For instance, you can look at separate indices of DeFi (Decentralized Finance) or NFTs (non-fungible tokens). This gives you the flexibility of investing in coins based on market trends, as well as individual coins.

As one example, if you are reading the news cycle and see that NFTs are trending up, but you don’t want to get caught in the wash of Ethereum or DigiByte, you can look up the entire NFT index on CoinSpot to research a hidden gem of your own.

Coin Swap

Sometimes it makes sense to swap one coin out for another, rather than selling it and buying a new coin on the market. For instance, let's say you want to make a big Bitcoin purchase, but all your funds are in ETH. Instead of making two transactions (selling ETH, then buying BTC), you can use Coin Swap, using CoinSpot's fixed prices. You will automatically convert your ETH to BTC, saving you time and fees.

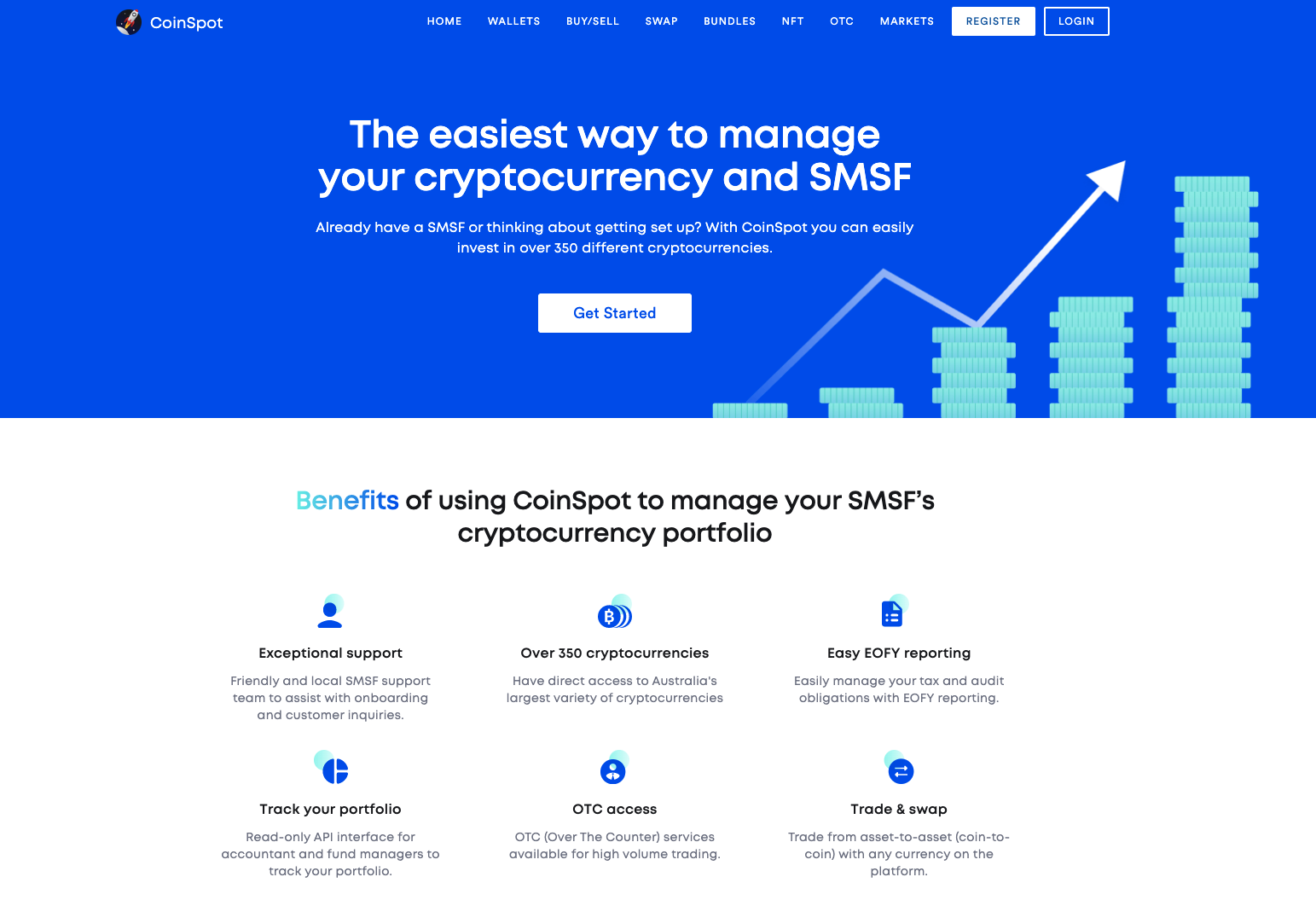

Crypto Self Managed Super Fund (SMSF)

The scope and experience of CoinSpot has given them insights into what investors may be looking for long-term. That has led them to feature resources for retirement. If you’re interested in starting an SMSF, or if you already have one, CoinSpot can help you get your cryptocurrency investing to help out.

CoinSpot has a specific SMSF team set up to answer your questions and help onboard your existing SMSF if you already have one. If you don’t, they can walk you through the process of getting your crypto investments set up to contribute to your SMSF.

Because CoinSpot has had experience handling retirement business, they also know the importance of easy tax reporting. That’s why they support fast and easy EOFY reports, to take the guesswork and worry out of the process.

OTC (Over The Counter) Service Desk

For some investors, success has smiled on their efforts, and in that case, they may find themselves in need of different services. In crypto, they call them OTC, or Over-the-Counter account services. CoinSpot offers some of the best OTC account management for high-volume trading.

OTC account management is available with an industry-low 0.1% fee and CoinSpot offers an “Instant” option with a minimum AUD amount of $50,000.

Negatives about using CoinSpot

High fees of 1% compared to competitors

Instant buy and sell fees on CoinSpot are 1% which is high compared to Swyftx (0.6%) and Digital Surge (0.5%). You can access lower fees by trading on the market, for just 0.1%, but unfortunately you can only trade 16 coins there. For all other coins, you can only purchase it instantly.

No advanced markets

While CoinSpot is excellent for beginners to crypto, experienced traders may not like the lack of advanced markets, such as futures, margin trading, and P2P.

Fees and Deposit Methods

Making AUD deposits to your CoinSpot account is easy. You can make AUD deposits for free with PayID or POLi. For a small fee, you can make deposits with BPAY (0.9%) or cash (2.5%) at any one of the thousands of BlueShyft locations around Australia.

CoinSpot's instant buy/sell fees are 1%, which is slightly higher than the industry average. However we do recommend the customer bear a few things in mind when comparing fees.

The first thing to keep in mind is security. I have devoted an entire section below to CoinSpot’s security and auditing history. They are one of the most impenetrable exchanges in Australia, and providing that level of security comes at a cost. You may pay a slightly higher trading fee, but that comes with peace of mind that your funds are with the most trusted exchange in Australia.

The second thing to keep in mind is that if you trad on CoinSpot Markets you can trade with any one of the other 2.5 million customers for 0.1% — an extremely competitive rate. However, it is important to note that you can only access a limited range of around 16 coins on the market. For all of the other coins, you can only buy and sell directly from CoinSpot.

Withdrawing AUD from CoinSpot is free of charge, while crypto withdrawals will incur a specific fee based on the coin you choose.

Security

CoinSpot offers 2FA security for all its accounts, meaning you’re getting the leading technology in account safety. In addition to that, once you’ve established your account, you can customise the security features there to any level you feel best about.

Outside of individual security, it’s good to know how a company handles its own security. After all, If your PIN is secure at the bank, but the bank itself is hacked, the PIN doesn’t matter.

In the cryptocurrency world, each transaction is secure by the nature of what blockchain technology is, but a crypto exchange itself still needs to be secure. There are several ways to gauge security in online business, but the highest industry standard is the ISO 27001 certification. This standard was developed jointly by the International Organisation for Standardisation and the International Electrotechnical Commission.

CoinSpot is the first Australian crypto platform to hold ISO 27001 certification, and is proud to retain it. In order to meet the ISO 27001 standard, CoinSpot submitted to an external audit that probed all of their processes, including customer data, data storage, supply chain, information management, storage, and retrieval, intellectual property, and employees.

In addition to multi-layered security for the user, CoinSpot is one of the only exchanges in Australia to be officially awarded the certification as a Blockchain Australia Certified Digital Currency Exchange provider. CoinSpot has long since been a proponent to the Australian Digital Currency Industry Code of Conduct and receiving this certification only solidifies CoinSpot’s position as Australia’s most trusted exchange.

Pros and Cons of CoinSpot

Conclusion

Finding a cryptocurrency exchange that operates right here in Australia and understands the needs of the Australian consumer can be difficult. But CoinSpot is leading the way, and has been since 2013.

With certifications and recognition for nearly every association related to cryptocurrency and online business, I can’t find a more reputable option for Australian crypto investing than CoinSpot. I recommend it to anyone looking for an easy way to buy, sell or trade cryptocurrency. If you decide to register with CoinSpot, don't forget to use my link here, and receive $20 FREE Bitcoin!

Frequently Asked Questions

Yes, and right on their website CoinSpot addresses this issue. Not only are they committed to conducting your business safely, they’re committed to your understanding of the business, as a whole. That’s why they offer an extensive list of tips for conducting your Bitcoin business safely.

With CoinSpot, you can safely and instantly transfer your Bitcoin assets into AUD at any time. You can easily withdraw your AUD from your CoinSpot dashboard to your Australian bank account for absolutely no charge, and with no withdrawal limits.

After you buy any cryptocurrency in CoinSpot, it is immediately available to see in your wallet. This wallet is also where you can track your purchases and sales, and see the current value of any of your digital assets. You can also see all of this from the CoinSpot app, available for Android or iOS.

When you opt to invest in coins in a bundle, or index, then you get to decide how much AUD you invest, rather than having to purchase a set amount of any one given coin. So if you invest $500 in a bundle, you’ll receive a percentage of each coin in the bundle, based on the market price of that coin. Then, each partial coin you’ve purchased will go into your wallet separately, filed under its individual coin name.

To read our privacy statement follow the link.