Is it Worth Mining Crypto in Australia?

Cryptocurrencies are more popular than ever and have become truly global with the worldwide attention they're currently getting. As the process of mining cryptocurrency becomes inundated with experienced and new miners, questions are asked about its efficiency and profitability.

Crypto miners — like myself — and investors in Australia have benefited from cryptocurrencies' growing popularity and now face the risk of market saturation. Amidst this confusion, there is only one question that miners ask: 'Is it worth mining crypto in Australia in 2024?'

In this article, we take a deep look at the profitability and basics of cryptocurrency mining and explore whether it is worthwhile for investors and miners in Australia to start mining today. Crypto mining requires a significant investment upfront, and miners should know exactly what they are stepping into and what they should expect from the process. We've got the perfect resource for you here today.

Understanding Crypto Mining

Cryptocurrency mining refers to the processes and steps that go behind validating transactions on the Bitcoin network and adding new blocks to the blockchain. The aim is to create new coins and cryptocurrencies in a decentralised manner.

However, this is as far as the simplicity goes. The steps for mining cryptocurrency include complex puzzles, creating algorithms, validating crypto transactions on the blockchain, and adding them to a related distributed ledger.

The Crypto Mining Process

The primary purpose of crypto mining, including Bitcoin mining, is twofold:

Miners add new blocks to the blockchain, creating new cryptocurrencies,

and validating transactions to prevent fraud or scams.

The crypto mining process includes the verification of new transactions on the Bitcoin network. This verification process ensures the production of new Bitcoins. Once the transactions are validated, they are added to the ledger.

Crypto mining is done by solving complex puzzles through enhanced computational power. The more computational power you have in the form of dedicated Application Specific Information Systems (ASICs), the easier it is for you to mine cryptocurrency. Cryptocurrency miners also validate and verify transactions on the network, again using the computational power we’ve discussed above.

The Concept of Proof of Work (PoW)

In proof of work mechanisms, we, the miners, compete against each other to solve complex problems. The first miner to solve these problems gets the right to add them to the blockchain. However, since cryptocurrency mining has become extremely challenging and competitive, it is unlikely for one single miner to mine a Bitcoin in full.

Hence, we recommend turning to mining pools in Australia that use the computational power of multiple mining systems to add blocks to the blockchain network.

Factors Affecting Crypto Mining in Australia

Let’s now look at the key factors affecting cryptocurrency mining in Australia and examine how these aspects influence the profitability and feasibility of mining.

Energy Costs and Electricity Rates

A significant factor impacting the success of crypto mining in Australia is the cost of energy. Mining requires a substantial amount of electricity to power the mining equipment and keep it running continuously. In Australia, the Average Annual Electricity price per kilowatt-hour (kWh) for industrial consumers in 2022 was approximately AUD 0.58. Electricity rates are higher than average and can take a major chunk of expenses for crypto miners. Lower electricity rates can make a considerable difference in the profitability of mining operations.

Climate and Temperature Considerations

Australia is known for its high temperatures, with annual average temperatures ranging from 15°C to 25°C according to the Bureau of Meteorology. During the summer months, temperatures frequently exceed 30°C. For crypto mining, this may lead to overheating issues with the mining equipment, which could decrease the hardware's efficiency and lifespan.

A Puget Systems study found a linear relationship between external (ambient) and internal PC temperatures. The study revealed that, when idle, a CPU's temperature increases by 1°C when the external temperature increases by the same amount. The case was the same when the CPU was active.

Consequently, adequate cooling solutions are essential for mining operations in Australia. These systems can increase the cost of mining and lead to an extra overhead.

Accessibility to Mining Hardware and Technology

Another factor to consider is the accessibility to the latest mining hardware and technology in Australia. Efficient and powerful hardware is crucial for competitive mining operations. The ability to source cutting-edge mining equipment and to keep up with advancements in mining technology can greatly influence the success of mining operations in the country.

Regulatory Environment and Taxation Policies

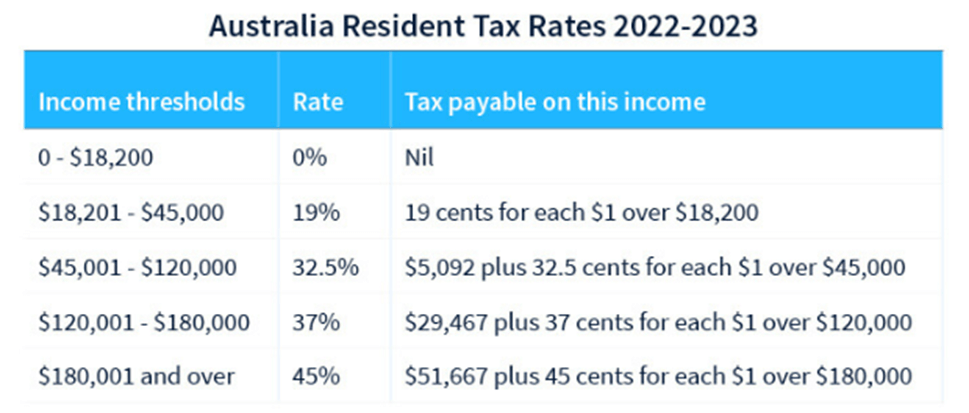

The regulatory landscape and taxation policies in Australia play a role in determining the profitability of mining cryptocurrency. The Australian Taxation Office (ATO) has established guidelines on the taxation of income generated from digital assets, including mining. The taxations on mining decrease your profitability and eat up the profits you make.

With the data-matching program introduced by the ATO in 2019, the tax office can now monitor the income made through crypto transactions. The table below summarises the resident tax rates for income made through crypto mining.

Analysis of How These Factors Influence Profitability and Feasibility

The key factors affecting crypto mining in Australia combine to determine the feasibility of mining in the region.

High energy costs can create challenges in maintaining profitability, especially without energy-efficient hardware. Furthermore, the hot climate means additional investments may be required for cooling solutions to preserve mining operations' efficiency.

However, if miners can source up-to-date mining technology and maintain their equipment, they may find themselves at an advantage over competitors using outdated hardware. Additionally, staying informed on the ever-changing regulatory and taxation environment is essential to avoid unexpected policy changes.

Insights into the Mining Landscape in Australia

The current cryptocurrency mining landscape in Australia is characterised by competition, with several mining farms operating throughout the country. Network difficulty continues to rise as more miners compete for the same block rewards.

Despite these challenges, there is still potential for well-informed miners who can navigate this complex landscape. By considering the factors discussed in this section and keeping track of fluctuations in the cryptocurrency market, it is possible to identify opportunities for success in Australia's cryptocurrency mining industry.

For instance, a miner can use the information in this section to move towards an alternate form of mining; cloud mining and mining pools come to mind here. Cloud mining for one minimises the impact of high electricity costs in Australia and also provides a safe investment option, without heavy stakes upfront.

Calculating Mining Profitability

Cryptocurrency mining can be a profitable venture in Australia. You can increase profits by minimising electricity costs and ensuring the upfront hardware costs are lower than the revenue you plan to make.

The current global annual BTC mining revenue at the time of writing is $10 billion, with the average gross profit coming to around 80%. We will discuss the factors involved in crypto profitability in greater detail later in this section:

Metrics Used to Assess Mining Profitability

There are numerous metrics used to assess mining profitability. These metrics include hash rate, electricity consumption, and mining rewards.

Electricity Consumption

Speaking from experience, we believe the electricity costs in developed countries like Australia, the United Kingdom, the United States, and Japan are on the higher end. Hence, your electricity costs will take a major chunk of the profits in these countries.

If you’re mining crypto in Australia, we recommend installing a sustainable source of renewable energy. Solar panels come to mind and can significantly decrease the expected kWh cost of mining in the country.

Hash Rate

The hash rate is a computational term in the world of cryptocurrency mining that determines the speed at which a mining machine operates. Always ensure we're using the latest and most energy-efficient mining hardware out there, like ASICs or GPUs with high hash rates and low power consumption. Remember, a penny saved is a penny earned!

Mining Rewards

Mining rewards include the final revenue or payout you generate after the arduous process of mining a cryptocurrency. Based on our experience, investors earn just over 6.25 BTC for mining an entire block, which amounts to around $243,000. However, it is very rare for a solo miner to mine an entire block.

Introduction to Mining Calculators

Mining calculators can be a good way to test the waters before you step into the world of cryptocurrency mining. A mining calculator can help you understand the profits you can get from a specific hash rate and possible energy costs.

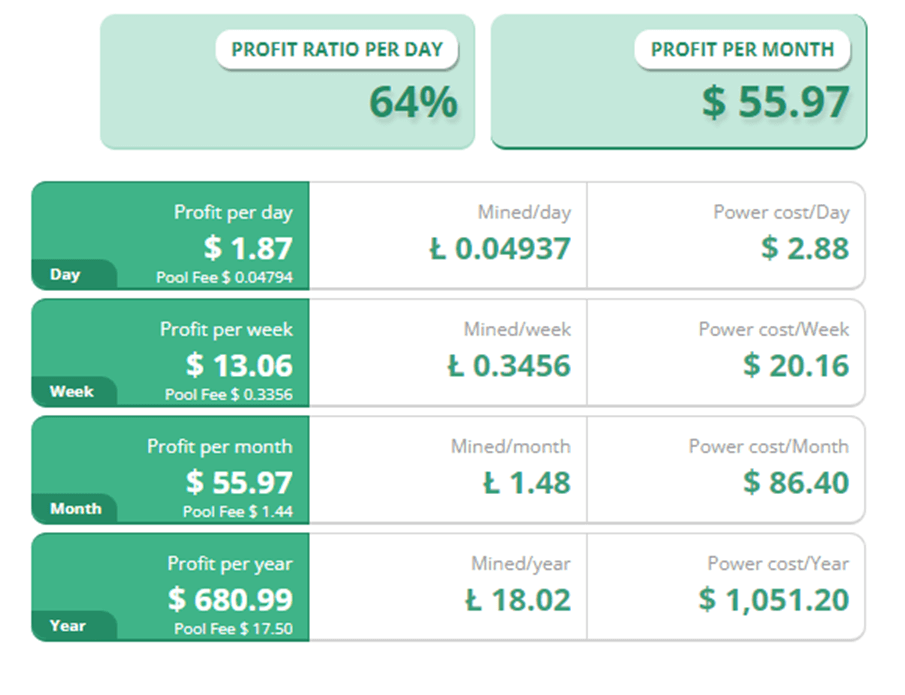

Estimates from mining calculators reveal that LTC is the cryptocurrency to mine with a profit rate of over 64%. You can even play with the separate input tabs for hash rate, electricity cost per kWh, and the currency at hand to see how much it takes to make a profit.

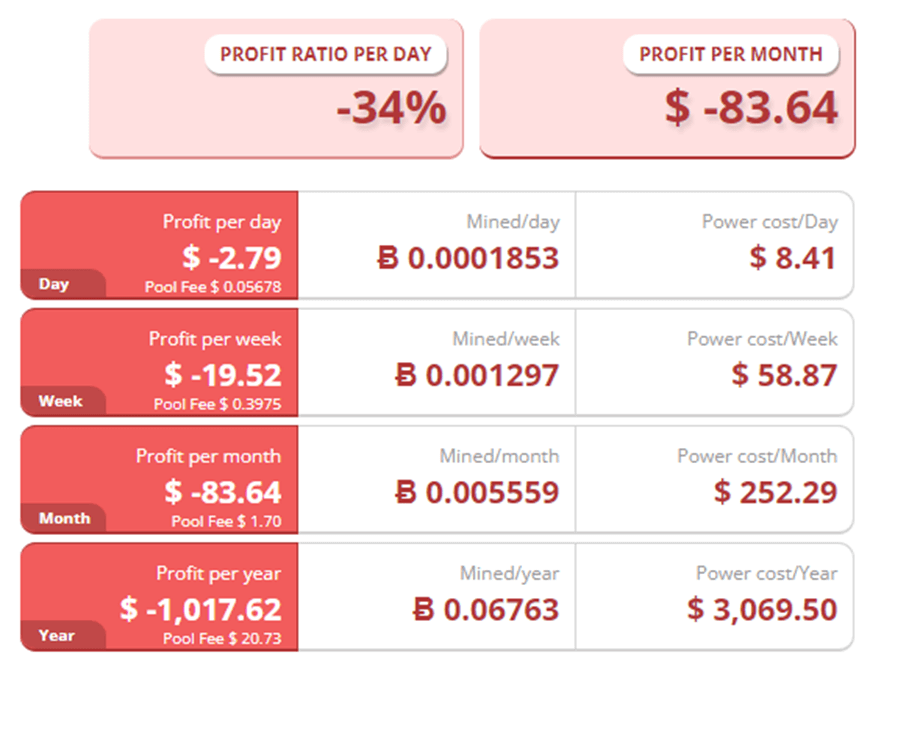

BTC is currently in the negative, with a possible loss for miners looking to mine the cryptocurrency. This does come down to the competition in BTC mining and how profits have shrunk because of it.

The case studies and examples above give you a fair estimate of the profitability of mining cryptocurrencies in Australia. The actual outputs you get from crypto mining can slightly vary from the actual estimates you get upfront from a calculator.

Risks and Challenges of Mining Crypto in Australia

As a potential miner, you need to be aware of the possible risks and challenges that come with mining crypto in Australia.

Volatility and uncertainty in cryptocurrency markets

The cryptocurrency market in general and Bitcoin in specific are known to be highly volatile. The prices can fluctuate dramatically and fall down rapidly. The volatility can make it challenging for miners to predict the value of their returns and profits accurately.

Equipment costs and maintenance expenses

Cryptocurrency mining requires high-end supercomputers to solve complex computational problems. When cryptocurrencies first came up, miners could mine cryptocurrencies from their personal computers at home.

However, the influx of miners and investors has pushed competition through the roof, and now dedicated systems for mining are required. Your Application Specific Integrated Circuit, or ASIC, is a special-purpose device created for mining cryptocurrencies. If you want to generate substantial results from your mining operations, then you need an ASIC to kickstart operations.

Besides the upfront costs of buying equipment, you also have to set aside funds for maintaining the equipment. Cooling costs can be high because of the extreme summers in Australia. Additionally, you need to run upgrades as you scale your mining operations.

Potential Regulatory Challenges and Legal Considerations

As crypto miners, we have to be aware of the regulations in Australia and how they concern us. It is legal to trade, receive, spend, and store cryptocurrency in Australia. However, merchants aren't obliged to accept it.

The current crypto environment is favourable for miners as BTC and other popular cryptocurrencies are in high demand. However, if government regulations do tighten up, miners will be the first ones to face the music as crypto prices could tumble, causing revenues to shrink.

Environmental impact and sustainability concerns

The energy consumption required for Bitcoin mining is a major point of concern due to its impact on the environment. Cryptocurrency mining needs high electricity usage, often leading to high carbon emissions and a possible energy deficit for the rest of the world.

Recommendations for Mitigating Risks and Challenges

Miners have the option to offset mining risks and challenges through calculated steps and measures. For starters, environmental risks can be offset by joining a mining pool that uses renewable sources of energy. PEGA Pool is a mining pool in Australia that offers green mining solutions and uses renewable energy.

Additionally, joining a mining pool can also help you get faster returns without the upfront investment of capital and funds. The returns come in faster, and you don't need to invest a hefty sum upfront. We look at mining pools in further detail in the next section.

Alternatives to Traditional Mining

With solo crypto mining becoming more competitive and less rewarding with the passing of the day, Australian crypto miners are looking for alternatives to traditional methods of mining. For a start, there are a few alternatives available which carry numerous benefits and minimise the risks mentioned above.

Cloud Mining

Crypto cloud mining allows crypto miners a chance to earn from mining without installing, maintaining, or buying any specialised hardware or software. Australian miners can be part of a pool of miners and use the cloud's computing capability for hosted mining.

Cloud mining can be a decent alternative to traditional mining, as it gives an easy exit option to users if the market for Bitcoin or other cryptocurrencies crashes. In addition, cloud miners do not have to deal with maintaining their equipment and therefore incur no maintenance costs.

The Amazon EC2 is a lucrative cloud mining option where miners only pay for the services they use. The leasing of hashing power can give miners the ability to mint coins through advanced computational power. NGS Crypto and Genesis Mining are the two other options that come to mind for Australian crypto miners.

Masternodes

Besides cloud mining, investors and miners can also invest in running master nodes. A master node is a Blockchain node that runs specific functions to support a network. Miners and investors in Australia who use master nodes can receive incentives such as crypto tokens and coins to help secure the network.

Running a master node works on the basis of collateral, where an operator should hold a required amount of cryptocurrency before running a node. A master node can get returns on a daily basis or even multiple times during the day.

We believe running Masternodes can be a good and profitable alternative to traditional mining because it does not require significant upfront gear and because miners do not need to send new blocks for verification in this model.

Conclusion and Final Thoughts

Crypto mining offers excellent opportunities for profiting from the crypto wave. While Australia is a crypto-friendly country and has fixed taxes in place for miners, the high rates of energy can be a major drawback.

We believe the best way to counter this problem is by installing renewable sources of energy, eg: solar panels in your home, or by opting for a cloud mining solution. As responsible miners, we should explore all connected factors to make mining a profitable venture.

For now, we believe that mining crypto in Australia is worth it. It can lead to profits if you spend time evaluating your options, and mine the right coin.