The British Government borrows money by selling bonds, known as 'gilts'. These bonds are sold at regular auctions held by the UK Debt Management Office (DMO), on behalf of Her Majesty's Treasury. The term gilt is short for 'gilt-edged security' and is a reference to their perceived safety as an investment. The Government has never failed to make a repayment on a gilt.

When a gilt is sold, the Government guarantees to pay the holder a fixed interest payment every six months until the maturity date, at which point the full value of the bond is repaid. The proceeds from a gilt sale are then spent by the Government and the value of the gilt is added to our national debt.

On average, the bonds that make up our national debt need to be repaid within 15 years. With government spending so far out of control, interest on the national debt will cost over £42 billion this year. Currently we can only afford to make repayments by selling even more gilts. When run on this basis, government deficit financing is similar to an illegal Ponzi scheme.

Who we owe the money to

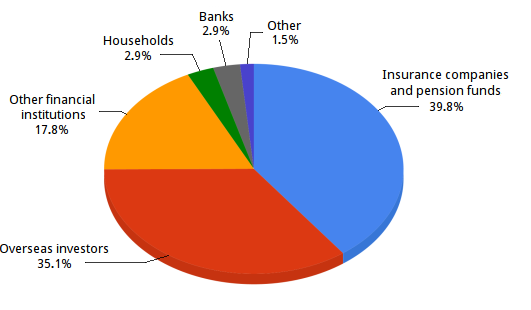

The DMO publishes a quarterly report that shows who currently owns the UK's debt, summarized in the pie chart below:

Although the majority of gilts are held by British institutions, it's worth noting that the amounts held overseas has risen sharply since 2003. Currently just over 35% of our national debt is owed to foreign governments and investors. So it's not just Third World nations in hock to the rest of the world. We're relying on the confidence of foreign investors to keep our own country afloat.