National debt is usually analysed as a proportion of a country's economic output, or Gross Domestic Product (GDP). This allows for factors like inflation and also reflects a nation's ability to repay the money it owes. All debt statistics on DebtBombshell are derived from official government forecasts, as set out by the Chancellor in his yearly Budget.

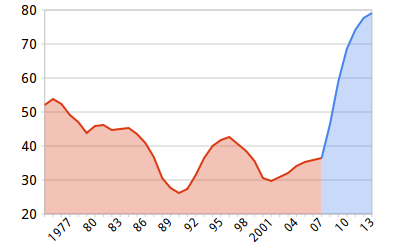

This graph shows the projected rise in Public Sector Net Debt as a percentage of GDP:

Future national debt levels depend on the state of the public finances, namely government spending plans, taxation and the country's economic performance. Any spending that can't be supported by taxation needs to be funded through borrowing. Therefore, if the economy performs more poorly than expected, tax revenues decline and we run up more debt to cover the shortfall.

What's more, if the Government's GDP forecasts are wrong, their national debt forecasts are wrong too. If recession is more severe or lasts longer than anticipated, the national debt-to-GDP ratio rises. Many independent forecasters believe the Government's own economic predictions are far too rosy.

The IMF forecasts the UK economy will shrink by another 0.4% in 2010, in sharp contrast to the Treasury's prediction of 1.25% growth. Independent forecasters surveyed by the Treasury believe that by 2011 the UK's economy will be 3% smaller than the Government predicts.

Ultimately this all boils down to one thing: the national debt is probably going to get a lot bigger than we think. New Labour will forever be remembered as the government that doubled the national debt, from 40% of GDP in 1997 to 80% in 2014.